If you’ve ever considered how to improve your business’s financial management, you’ve likely heard of remote certified public accountants (CPAs) before.

Nowadays, CPA jobs have evolved beyond the traditional office cubicle. Hence, this article dives into the role of remote CPAs and why they’re becoming game changers for business clients of all kinds.

From understanding their responsibilities to recognizing their benefits, we’ve got it all covered. We’ll explore what a remote CPA is, as well as the benefits of hiring one. Additionally, we’ll delve into the key qualities to look for in a remote CPA and things to account for when hiring one.

Let’s get into what a remote accountant can do for your business.

What Is a Remote CPA, and What Do They Do?

A remote CPA is a certified accountant who works outside traditional office environments. They handle typical CPA responsibilities, like audits, tax planning preparation, tax returns, payroll management, and financial data planning, but with the added benefits of flexibility and global accessibility.

Contrasting roles: Remote CPA vs. in-house CPA

While both remote CPAs and in-house CPAs hold similar qualifications, their work environments change how they perform their duties.

In-house CPAs tend to have more direct, in-person interaction with other team members (like the in-house accounting department), while remote CPAs excel in digital communication. They often have a more flexible schedule, similar to other commonly outsourced professionals, like software developers or marketing specialists.

5 Benefits of Hiring a Remote CPA

Hiring a remote CPA offers a series of benefits that go beyond traditional accounting roles. From reducing overhead costs to accessing a global pool of expertise, here are five reasons why a remote CPA might be the strategic asset your business needs:

Cost efficiency

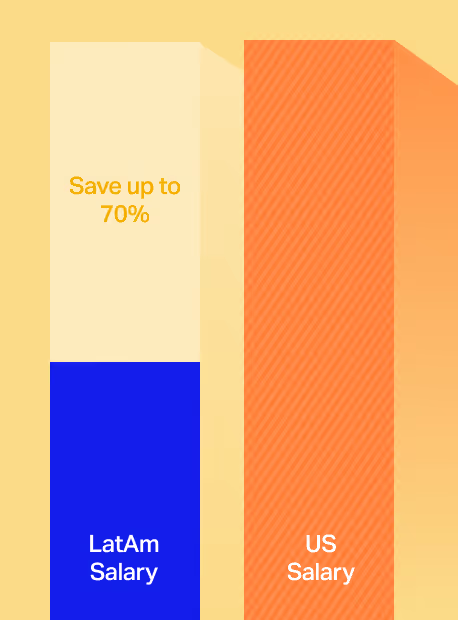

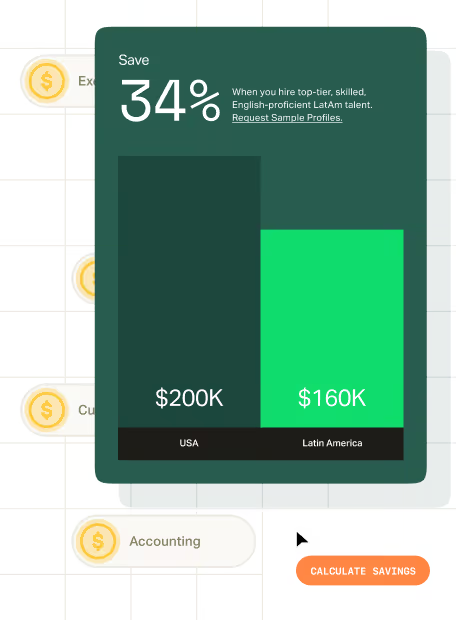

By encouraging remote work, you diminish the need for physical office spaces. In fact, remote work can save businesses up to $11,000 in overhead costs per employee. Additionally, remote CPAs can be less expensive than in-house accountants if you outsource to areas with a lower cost of living.

Access to global talent

There are many opportunities to hire top-tier accountants from a global pool. Since you have a wider selection, it’s easier to find CPAs with the specialized skills needed for your role.

For instance, a US-based firm hiring a CPA from Latin America might benefit from gaining expertise specific to international finance regulations, helping to expand its business processes.

Flexibility

Depending on your business needs, remote CPAs may be available on different schedules, offering round-the-clock service. Hence, your accountant can analyze financial data in real time, regardless of their full-time location.

By hiring CPAs on a contract or per-project basis, you can also utilize their accounting services as needed without incurring unnecessary costs.

Technology proficiency

Remote CPAs are digitally savvy, as they master communication tools and digital platforms as part of their jobs as remote workers. Digitally transforming your business is easier with remote workers by your side.

Pro Tip: Consider using collaborative online platforms like Slack or Trello for easy communication and project management with your remote CPA. This fosters transparency and keeps you updated on your financial status in real-time.

What Qualities Should You Look for When Hiring a Remote CPA for Your Business?

Finding good remote CPAs can be challenging. However, understanding the right qualities to look for makes the process smoother and more rewarding.

Here are five aspects to watch out for to help identify the ideal remote CPA for your business:

Certifications and experience

Your ideal prospects should possess the required certifications—like a bachelor’s degree and the Certified Internal Auditor (CIA) certification—and relevant experience in the industry.

For instance, an e-commerce CPA may require insights into online sales tax nuances. To find expert-vetted remote accountants, consider outsourcing your search to finance and accounting outsourcing providers.

Communication skills

Given the remote nature of their job, exceptional digital communication skills are crucial for this role. Check candidates’ proficiency in using communication tools like Slack or Zoom. Their ability to convey complex financial information is vital, and so is their responsiveness rate, ability to meet deadlines, and language proficiency.

Tech-savviness

A proficient remote CPA must be adept in the latest accounting technologies. They should be familiar with cloud-based accounting software like QuickBooks Online or other accounting tools and possibly even advanced data analysis tools.

Time management

Remote work comes with the challenge of managing time effectively. A high-caliber remote CPA should be able to prioritize tasks and meet deadlines consistently, ensuring your financial operations run smoothly.

Cultural fit

Besides hard and soft skills, your CPA must align with your company’s culture, sharing your business values and work ethic. For example, if your business prioritizes sustainability, a CPA who understands and supports these values can provide more aligned financial advice and corporate social responsibility best practices.

Things To Consider When Hiring a Remote CPA

When hiring a remote CPA, it’s important to delve deeper into certain aspects to ensure you find the right fit for your business. Let’s break down these considerations:

Can they meet your specific business needs?

Examine how well the remote CPA can integrate their workflows with your existing financial systems. Assess their ability to work with specialized software or proprietary systems unique to your business. Prepare a dedicated list of questions to ask the accounting expert to assess their fit.

Do they offer strategic advice?

If possible, seek a CPA who can not only manage clients’ accounts but also advise on financial strategies. For example, they could mentor staff accountants, offer insights on tax-saving opportunities, or give advice on cash flow management tailored to your services and business model.

Are they prepared to deal with potential business crises?

Inquire about their experience in crisis management or business continuity planning. Research their past business clients and news, or simply search their name on Google to see whether they were involved in such situations and how they handled them.

Do they understand financial regulations and compliance?

If your business operates in a highly regulated industry, your CPA should be knowledgeable about and up to date on specific compliance and regulatory requirements and be able to identify audit risks.

What is their cost structure?

Understand their fee structure—is it hourly, fixed, or based on the accounting services provided? A clear understanding of costs up front will help you avoid surprises later. Communicate your financial goals and expectations from the outset.

Pro Tip: Use LinkedIn to vet potential CPAs. Their recommendations, endorsements, and network can provide insights into their professional credibility and fit for your business.

Final Thoughts

It’s clear that remote CPAs can be pivotal in shaping your financial management for the better. Here’s a quick recap of what makes them invaluable:

- Offering remote accounting jobs enables you to tap into global talent while managing costs better.

- A remote CPA may be more knowledgeable in tech trends and have a high level of technological proficiency.

- When hiring a remote accountant, one often overlooked aspect is ensuring they align with your company’s culture and values.

- Security and adaptability should also be top priorities.

The next step is finding a remote CPA who not only meets these criteria but elevates your financial operations. We specialize in connecting you with remote CPAs who are not just qualified but also resonate with your business model and contribute to your strategic goals.

Book a free consultation call to discover the ideal remote CPA solution. This is a no-commitment call that can put you in touch with accounting experts at up to 70% lower salary costs.

.avif)

.avif)

%20(1).avif)

%20(1).png)