Key Takeaways

- Outsourcing finance and accounting functions can enhance operational efficiency and reduce costs for businesses of all sizes.

- Latin American countries such as Mexico, Colombia, and Brazil offer highly skilled professionals and cost-effective solutions for finance and accounting outsourcing.

- Staffing and recruiting companies like Near and outsourcing firms like IBM and Deloitte serve different needs: hiring direct gives you dedicated team members, while outsourcing provides project-based services.

Your finance team missed another month-end deadline, and now your investors are asking pointed questions about cash flow projections you can't provide.

The accounting talent shortage in America has made qualified financial professionals nearly impossible to find locally, and when you do find candidates, salary expectations have skyrocketed as companies compete for a shrinking talent pool.

Many companies are looking to outsource or hire remote talent to compensate for the difficulty in finding qualified accounting professionals.

This guide breaks down 11 top finance and accounting solutions, from outsourcing providers to staffing agencies that help you hire dedicated team members. You'll learn which approach fits your specific needs and how to solve the talent shortage without compromising on quality or breaking your budget.

What Is Finance and Accounting Outsourcing?

Finance and accounting outsourcing involves hiring external service providers to manage your finance and accounting processes. Outsourcing these tasks can benefit you by reducing costs, improving compliance, providing access to expert skills, and allowing your internal teams to focus on core business activities.

For a more comprehensive discussion, including a deeper dive into the benefits of this approach, check out our full guides on finance outsourcing or accounting outsourcing.

Is Outsourcing Finance and Accounting Right for Your Business?

Deciding whether to outsource finance and accounting functions depends on several factors. Here are considerations that can help gauge if it’s the right move:

Business size and complexity

If your business is growing rapidly and the complexity of financial transactions is increasing, managing everything in-house may become too burdensome, leading to errors and inefficiency. Outsourcing can bring the needed expertise and scalability.

Available resources

Maintaining an in-house accounting team comes with inherent costs, such as salaries, benefits, and training, which is why many teams combine outsourcing with Invoice Management Software to boost efficiency and cut expenses. If you are working with limited resources or trying to optimize back-office functions to lower overhead, outsourcing may offer a more cost-effective solution without compromising on the quality of service.

Employee workload

If your staff is already stretched thin—and wearing multiple hats or spending too long on simple tasks—handing off some finance and accounting functions can free up time to focus on what matters most for your business growth and development.

Organizational expertise

Outsourcing can be a viable option if you recognize a skill gap within your organization, particularly in areas that require specialized knowledge, such as:

- Tax laws

- Regulatory compliance

- Cash flow management

- Sophisticated financial analysis

Instead of training an in-house employee, you can gain immediate access to expertise through finance and accounting providers.

Risk tolerance

Assess your company’s risk tolerance regarding financial errors and compliance risks. Outsourcing can be an effective risk management method, especially if your staff lacks experience in finance and accounting tasks.

Finance and Accounting Functions You Can Outsource

Whether your business is large or small, here are some examples of finance and accounting services that can be effectively outsourced to professional service providers:

Bookkeeping

Outsourcing bookkeeping services—including day-to-day transactions and account reconciliation—can save your business time and ensure accurate financial records.

Payroll processing

Payroll processing is both time-consuming and complex, involving employee records, salary calculations, tax deductions, and labor law complications. If you choose to outsource your payroll, accounting experts will make sure your employees are paid on time while complying with all regulations.

Accounts payable and receivable

Efficiently managing your accounts payable and receivable helps maintain good supplier relations and ensures a steady cash flow. An outsourcing partner can handle invoice processing, payment tracking, and collections, freeing up internal resources for other activities.

Tax preparation

Outsourced tax-related functions can help ensure accurate filings, minimize your liabilities, and keep your business compliant with local, state, and federal requirements.

Financial reporting

Producing regular financial reports helps you monitor business performance and make informed decisions. Experienced providers can provide not only high-quality reports but also actionable insights based on their experience in the accounting outsourcing industry.

Audit support

Preparing for (or undergoing) financial audits is extremely resource-intensive. Outsourced providers can help your business get audit-ready by organizing your financial records, providing necessary documentation, and supporting you throughout the process.

Financial analysis

Outsourcing financial planning and analysis (FP&A) allows you to gain deeper insights into your company’s overall financial health. Professional financial analysts can perform ratio analysis, trend analysis, and other data-driven evaluations to help you make strategic decisions.

Controller services

A controller oversees the financial and accounting functions within a company, ensuring accuracy and integrity. Normally a full-time, in-house role, controllers are also available on a fractional basis as part-time, remote support staff to help with month close or seasonal growth periods.

{{state-latam-hiring}}

Hiring Your Own Finance and Accounting Team in Latin America: An Alternative to Outsourcing

If cost savings are your primary motivation for considering outsourcing, hiring dedicated finance professionals in Latin America often provides the same savings with significantly more control and better results.

Rather than paying project fees to outsourcing companies, you get full-time expertise and integrated team members.

Benefits of hiring over outsourcing:

- Direct oversight and control over processes, deadlines, and quality standards

- Better cultural alignment since your hire becomes part of your company culture

- Consistent availability during your business hours instead of competing for attention with other clients

- Long-term relationship building that improves performance over time

- Complete transparency into work processes and methodologies

- Scalability without renegotiating contracts or service agreements

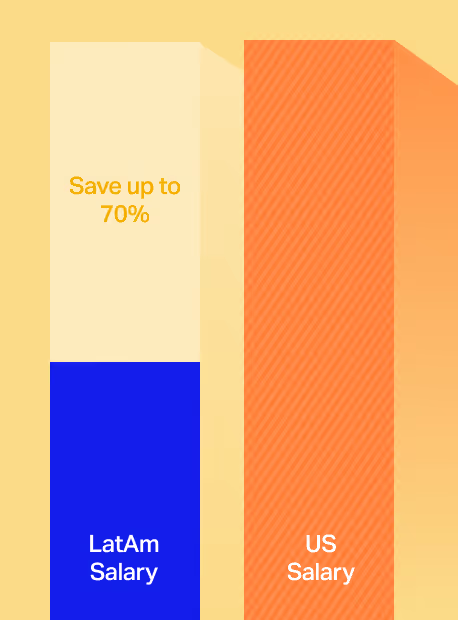

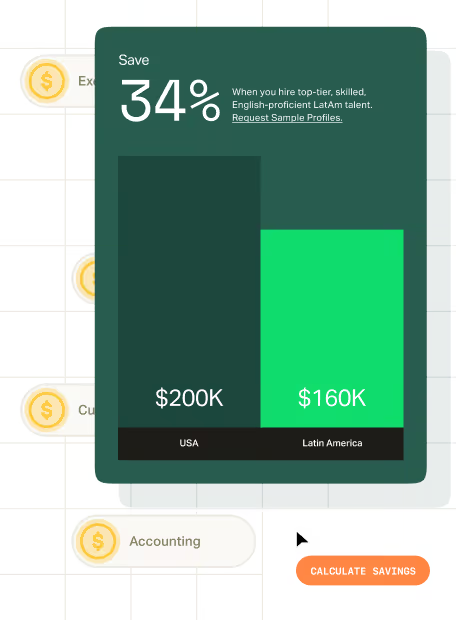

According to Near's State of LatAm Hiring Report, companies hiring finance and accounting professionals in Latin America typically save 40-60% compared to US salaries while maintaining the same quality of work.

Companies like FinanceWithin successfully scaled their hiring when they couldn't find qualified professionals locally, using a staffing approach instead of traditional outsourcing to maintain better control over their growing financial operations. They are now saving $535,000 annually compared to hiring in the US.

US vs. LatAm Average Salaries

Top 11 Best Finance and Accounting Outsourcing Providers

We evaluated these finance and accounting outsourcing companies based on third-party reviews on platforms like G2 and Clutch, verified client testimonials, the breadth of services they offer, and their overall reputation in the industry.

This list includes both traditional outsourced finance and accounting services providers—where you contract with a firm to handle specific functions—and recruiting agencies that help you hire dedicated finance and accounting professionals who work exclusively for your company.

The best way to determine which provider is right for your specific situation is to get on a call with them.

Most reputable firms offer free consultation calls where you can discuss your needs, timeline, budget, and whether their model aligns with how you want to structure your finance operations.

The companies below represent top options across both approaches. Each brings specific strengths—whether you're a small business looking to outsource accounting services or a growing company considering building your own finance and accounting team.

1. Near

Near (Hire With Near) is a full-service staffing and recruiting agency that helps US companies of all sizes hire top-performing remote talent in Latin America across finance, accounting, sales, software engineering, AI, data, design, marketing, operations, and virtual assistance.

Unlike traditional outsourcing providers, Near helps you build your own dedicated finance team with professionals who work exclusively for your company during your business hours.

You get the cost benefits of working with Latin American talent while maintaining complete control over processes, deadlines, and quality standards. When you hire through Near, these professionals—accountants, controllers, AR specialists, financial analysts—become part of your team, not external contractors juggling multiple clients.

Key advantages:

- Done-for-you hiring process that typically takes under 3 weeks from job description to signed offer.

- Access to top-tier LatAm talent who perform like your best US hires.

- Zero upfront costs. Once you make a hire, choose between a one-off placement fee or monthly fee, depending on whether you want us to handle payroll and compliance.

- Proven track record with a 97% placement success rate, 9.1+ client satisfaction score, and 4.9 out of 5 rating on G2..

- Pre-vetted talent pool of over 45,000 candidates, plus custom sourcing to find talent that meets your exact requirements.

CyberFortress saved over $1 million annually by building their accounting team through Near instead of using traditional outsourcing providers, gaining both significant cost savings and the control that comes with having dedicated team members.

This is what CyberFortess’s CFO, Seema Chacko, had to say about her experience working with Near:

We hired 20 team members who share our core values: great attitude and desire to learn, resourcefulness, and adaptability. Near’s team was very responsive, and their easy-going communication fostered a seamless hiring process.

2. IBM

IBM has long outgrown its image as merely a computer company, evolving into a behemoth of tech innovation. Its consulting and outsourcing branch leverages the company’s cutting-edge technology to provide an extremely modern and efficient workflow for finance and accounting functions.

With advanced analytics, artificial intelligence capabilities through Watson, and process automation tools, IBM offers a comprehensive package for financial outsourcing.

Key features:

- Technology integration: Advanced AI and automation capabilities for process optimization

- Global scale: Extensive infrastructure supporting multinational operations

- Enterprise focus: Designed for large organizations with complex financial requirements

3. Auxis

Auxis is a full-service back-office outsourcing solution catering primarily to mid-market and enterprise-level clients. It offers tailor-made finance outsourcing services, capitalizing on a combination of deep industry knowledge and practice expertise.

Auxis handles traditional accounting functions and more complex FP&A, with a strong focus on technology. It emphasizes process optimization through automation, employing tools and platforms that reduce manual intervention.

Key features:

- Industry specialization: Deep expertise in specific sectors and regulatory requirements

- Process automation: Focus on reducing manual intervention through advanced tools

- Mid-market focus: Tailored solutions for growing companies with complex needs

4. Bookkeeper360

Bookkeeper360 is a terrific option for US-based small businesses seeking dedicated accounting support. It has tailored its professional outsourced accounting and financial services specifically to cater to the unique demands of SMEs.

Specializing in cloud-based accounting solutions, Bookkeeper360 integrates with platforms like Xero and QuickBooks to offer real-time financial insight, which is crucial for the fast-paced environments common among small businesses.

Key features:

- Small business focus: Services tailored specifically for SME unique demands

- Cloud integration: Seamless integration with popular accounting platforms

- Real-time insights: Immediate access to financial data for fast-paced environments

5. AccountingDepartment.com

AccountingDepartment.com provides an entire expert team dedicated to managing various finance and accounting tasks for your business.

With a focus on serving small and medium-sized businesses, AccountingDepartment.com offers comprehensive services, including everything from daily bookkeeping and advanced accounting to controller services and strategic planning.

Key features:

- Complete team approach: Dedicated professionals across all finance functions

- SMB specialization: Understanding of small business operational challenges

- Strategic planning: Beyond transaction processing to business advisory services

6. IBN Tech

No, not IBM again—this time, it’s IBN, a global finance and accounting outsourcing firm based in India but with offices in the US and UK.

Offering everything from simple bookkeeping to virtual CFO services, IBN ensures that your financial data is accurate, your processes are streamlined, and your compliance needs are squarely met—all while helping you cut operational costs.

Key features:

- Global presence: Multi-country operations with 24/7 support capabilities

- Comprehensive services: Full spectrum from bookkeeping to executive-level advisory

- Cost efficiency: Significant cost reductions through offshore delivery model

7. KPMG

KPMG is a global leader in audit, tax, and advisory services. Its finance and accounting outsourcing solutions cover everything from bookkeeping and payroll to complex tax compliance and financial analysis.

Extensive industry knowledge and global reach ensure that KPMG delivers top-tier service tailored to each client’s unique needs.

Key features:

- Global consulting expertise: Access to worldwide industry knowledge and best practices

- Regulatory compliance: Deep understanding of complex tax and regulatory requirements

- Industry specialization: Sector-specific expertise across multiple industries

8. Deloitte

Deloitte offers comprehensive finance and accounting outsourcing services designed to enhance performance and compliance. As one of the leading accounting firms in the world, its services include everything from financial reporting to CFO advisory services.

Deloitte’s innovative solutions make it a valuable partner for businesses trying to optimize their finances.

Key features:

- Innovation focus: Cutting-edge solutions and emerging technology adoption

- Performance optimization: Focus on enhancing operational efficiency and compliance

- Strategic advisory: High-level CFO services and business strategy support

9. PwC (PricewaterhouseCoopers)

PwC is renowned for its extensive range of professional services, including finance and accounting outsourcing. With experience in industries like media and entertainment, energy, and banking, its commitment to quality and adherence to the highest standards of compliance never falters.

Key features:

- Industry depth: Specialized expertise across multiple sectors

- Compliance excellence: Rigorous adherence to highest standards

- Global network: Extensive worldwide presence and capabilities

10. BDO

BDO provides a wide range of outsourced finance and accounting services tailored to meet the needs of both large enterprises and smaller businesses.

Its offerings include bookkeeping, payroll, tax compliance, financial reporting, and audit support. BDO’s personalized approach and deep industry expertise ensure high-quality service delivery.

Key features:

- Personalized approach: Customized service delivery based on specific client needs

- Scalable solutions: Services that grow with business requirements

- Comprehensive support: Full range from basic bookkeeping to strategic advisory

11. Accenture

Accenture delivers cutting-edge finance and accounting outsourcing services leveraging advanced technologies and deep industry knowledge. Its services include automated bookkeeping, payroll, tax services, financial reporting, and strategic financial advisory.

Accenture’s innovative solutions help businesses enhance efficiency and drive growth.

Key features:

- Technology leadership: Advanced automation and intelligent process solutions

- Innovation emphasis: Cutting-edge approaches to traditional finance functions

- Growth enablement: Solutions designed to drive business efficiency and expansion

{{prevetted-banner}}

5 Best Countries To Outsource Finance and Accounting Roles

When choosing a country to outsource finance and accounting roles, it’s important to consider factors such as the local talent pool, cost effectiveness, time zone compatibility, and the level of technological infrastructure.

Here are five of the best countries to consider for outsourcing finance and accounting:

1. Mexico

Mexico is an attractive destination for outsourcing finance and accounting roles due to its proximity to the US, making it a convenient location for companies seeking time zone compatibility and ease of communication.

The country has a strong pool of bilingual accountants, and its lower cost of living (despite its robust business infrastructure) makes it an efficient outsourcing option.

2. Argentina

Argentina is another excellent option in LatAm for outsourcing finance and accounting roles. The country has a well-educated workforce with the highest English proficiency in the LatAm region (higher than many European countries).

Competitive cost structures and high-quality service offerings make Argentina an attractive outsourcing destination.

3. Colombia

Colombia has emerged as a leading outsourcing destination in LatAm, supported by a growing tech and service industry. The country offers a highly educated workforce with expertise in finance and accounting.

Colombia’s favorable business environment, competitive labor costs, and relatively close location provide excellent advantages for US companies looking to outsource finance and accounting functions.

4. Brazil

Brazil boasts a large, skilled workforce with significant expertise in finance, accounting, and related fields. The country’s economic strength and well-developed business infrastructure enhance its appeal as an outsourcing destination.

Although language can be a barrier, English proficiency in the nation is on the rise, particularly among professionals in finance. Brazil’s time zones overlap with parts of the US, which also facilitates efficient communication.

5. India

India remains one of the top global destinations for outsourcing finance and accounting roles due to its massive talent pool and low labor costs. Indian outsourcing firms offer a wide range of services, from bookkeeping and payroll processing to complex financial analysis and tax compliance.

However, US companies will have to deal with a significant time difference, which could lead to misunderstandings or poor communication.

{{salary-guide-cta}}

Final Thoughts

The choice between outsourcing finance and accounting functions versus building your own remote team depends on your specific needs for control, collaboration, and long-term growth.

While traditional outsourcing providers excel at project-based work and specialized consulting, staffing solutions like Near give you dedicated professionals who work exclusively for your company.

Companies consistently report better outcomes when they have direct control over their finance operations rather than competing for attention with other clients.

With Near, you can build a world-class finance team in Latin America while saving 30–60% compared to US hiring costs, without sacrificing the quality or collaboration that drives business success.

Schedule a free, no-commitment consultation call today to explore how dedicated LatAm finance professionals can transform your financial operations while keeping costs manageable.

Frequently Asked Question

What are the challenges of outsourcing accounting?

One potential challenge of outsourcing accounting is the risk of data security and confidentiality breaches, as sensitive financial information is shared with a third party. Additionally, companies may experience a loss of direct control over financial processes and rely heavily on the outsourcing partner’s reliability.

Thoroughly vet your outsourcing provider before signing any contract, and ensure that they have up-to-date security measures.

Can you outsource a CFO?

Yes, you can outsource a CFO through fractional CFO services or virtual CFO firms. This allows you to benefit from strategic financial leadership without the cost of a full-time executive. Outsourced CFOs provide high-level financial planning, oversight, and strategic advice tailored to your company’s needs.

You could also consider hiring a CFO in Latin America if the cost of hiring in the US is prohibitive. In the US CFOs expect to earn $246,000 to $455,00. In contrast, a CFOs salary expectations in LatAm are usually $120,000 to $180,000.

Do accounting firms outsource?

Yes, accounting firms sometimes outsource certain accounting and finance tasks to take advantage of cost savings and focus more on their core financial activities. Given that 42% of accountants turn away work because of staff shortages, outsourcing can also be a strategic solution to fill talent gaps.

Some of the financial services most commonly outsourced by accounting firms include bookkeeping, payroll, accounts payable and receivable, and financial reporting.

How do I evaluate the ROI of outsourcing vs. hiring my own team?

Consider total costs including salaries, benefits, training, and technology, then compare against outsourcing fees.

Factor in control, cultural fit, and long-term scalability. Many companies find that building dedicated international teams offers the best of both worlds—significant cost savings with better control and integration.

See our LatAm vs. US Salary Guide to get an idea of the cost savings you can expect from hiring accounting and finance professionals in Latin America.

What are outsourced finance and accounting services

Outsourced finance and accounting services involve hiring external providers to manage specific financial functions like bookkeeping, payroll processing, tax preparation, and financial reporting.

Companies choose outsourcing to reduce overhead costs, access specialized expertise, and free internal resources for strategic priorities. Providers range from full-service firms handling all accounting operations to specialists focused on particular functions like controller services or FP&A.

Can you outsource accounting services for small businesses?

Small businesses can effectively outsource accounting services to manage bookkeeping, payroll, tax preparation, and financial reporting without maintaining a full in-house team.

Many providers specialize in small business needs, offering scalable services that grow with your company.

Cloud-based platforms enable real-time access to financial data, making outsourced arrangements as seamless as having an in-house team.

The decision depends on your budget, complexity of financial operations, and whether you need dedicated team members or project-based support.

.avif)

.avif)

%20(1).avif)

%20(1).png)