As businesses grow and evolve, so does the complexity of their financial processes. Accounts payable service outsourcing has emerged as a popular solution for companies looking to streamline their operations and improve efficiency. But is this the right move for your organization?

In this comprehensive guide, we’ll explore everything you need to know about accounts payable service outsourcing: the pros and cons, the functions you can outsource, the top accounts payable outsourcing companies, and tips for choosing the best provider. Get ready to unlock the potential of accounts payable service outsourcing.

What Is Accounts Payable Outsourcing?

Accounts payable (AP) outsourcing is entrusting your organization’s accounts payable processes to a third-party company specializing in managing accounts payable. This can range from invoice receipt and processing to vendor management and payment processing.

Companies might outsource their accounts payable functions, including the entire accounts payable department, for various reasons, such as cost savings, improved efficiency, and easier compliance with financial regulations.

The growing popularity of accounts payable outsourcing and accounting outsourcing, in general, can be attributed to a sustained need to make cost savings and compensate for labor shortages. Companies are embracing business process outsourcing (BPO) as a strategic solution to overcome challenging economic conditions.

However, it’s essential to weigh the benefits of outsourcing against the potential risks—such as lack of data privacy and security concerns, loss of direct control, and communication challenges—to determine whether accounts payable outsourcing is suitable for your business.

Understanding Accounts Payable Services

When considering accounts payable outsourcing, it’s essential to understand the services provided by accounts payable outsourcing companies. They offer a range of technology, personnel, and value-added consulting services to help manage your accounts payable processes more efficiently. Some of the most frequently outsourced processes include invoice receipt and processing, vendor management, and payment processing.

Below we’ll look at these key services and how outsourcing these functions can benefit your business.

Invoice receipt and processing

Invoice receipt and processing is a crucial aspect of accounts payable outsourcing services. Providers offer services such as receiving hard copy and electronic invoices, matching invoices with purchase orders, processing debit memos, and image and data capture.

Efficient invoice receipt and processing can lead to cost savings and improved accuracy, reducing the likelihood of manual data entry errors and facilitating better cash flow management. By partnering with an experienced outsourcing provider, your organization can benefit from their expertise and technology to streamline this function.

Vendor management

Vendor management services are essential for cultivating positive partnerships and optimizing supplier communication. By handling tasks such as vendor onboarding, maintaining up-to-date vendor records, and resolving vendor disputes, accounts payable outsourcing providers can help your organization maintain healthy vendor relationships, which are crucial for the success of your business.

Poor vendor management can lead to issues such as overpayments on invoices, missed early payment discounts, and even loss of contracts with key suppliers. Outsourcing vendor management tasks can ensure that vendor relationships are well-maintained.

Payment processing

Efficient payment processing is another key service provided by accounts payable outsourcing companies. By ensuring timely and accurate payments to your vendors, your organization can benefit from improved cash flow management and reduced invoice processing costs. Prompt payment also helps to strengthen vendor relationships, leading to better terms and increased discounts.

Outsourcing payment processing tasks to a reliable provider also reduces the risk of payment fraud and errors, as they employ advanced technologies and processes to identify, eliminate, and minimize such risks. This can ultimately save your organization time and money while maintaining a high level of accuracy and compliance.

By outsourcing the tasks above, your organization can focus on more strategic activities and let the outsourcing provider handle the time-consuming and tedious aspects of AP functions.

Top 3 Accounts Payable Outsourcing Companies

While this article focuses on accounts payable outsourcing specifically, companies looking for broader CPA accounting services may want to explore other CPA accounting outsourcing companies as well. Below are three leading providers specializing in AP outsourcing:

As the demand for accounts payable outsourcing services continues to grow, so does the number of providers, making narrowing down your choices challenging. To help you start your search, we’ve listed our recommendations for the top three companies offering accounts payable outsourcing. Each of these companies offers a unique set of services and solutions to help streamline your accounts payable processes and improve overall efficiency.

ILM Corp.

ILM is a Virginia-based provider of accounts payable services to commercial clients, government entities, and nonprofits. They utilize artificial intelligence and machine-learning algorithms in their smart-scanning and exception-handling technology, ensuring efficient and accurate invoice receipt and processing.

In addition to invoice receipt and data capture, ILM also offers services such as PO matching, invoice processing and routing, disbursement, accrual, general ledger, and archiving functions.

With over 18 years of experience in the industry, ILM ensures high-quality AP outsourcing services, with expertise in all major payments and ERP systems.

Genpact

Genpact provides a comprehensive range of AP outsourcing services, including invoice receipt and processing, vendor management, and payment processing. They strive to offer cost savings, improved efficiency, and increased visibility and control for their clients.

When working with Genpact, businesses can expect a dedicated project manager and a team of experts to handle their accounts payable tasks, ensuring smooth communication and timely execution. By partnering with Genpact, organizations can focus on their core business activities while an experienced team effectively manages their AP processes.

Accenture

Accenture is a global professional services firm renowned for its expertise in providing a wide range of outsourcing solutions, including accounts payable outsourcing. With its extensive experience and a strong presence in the US, Accenture offers valuable support to businesses seeking to optimize their accounts payable processes. They provide a range of services, such as invoice receipt and processing, vendor management, and payment processing, ensuring timely and accurate payments for their clients.

Businesses working with Accenture can benefit from cost-effective solutions and a high level of expertise in managing their accounts payable processes.

Benefits of Using an Accounts Payable Service

Outsourcing accounts payable processes can offer a wide range of benefits to businesses, such as cost savings, improved efficiency, and enhanced visibility and control over financial transactions.

Below, we’ll explore these benefits and how they can directly impact your organization’s bottom line.

Improved efficiency

Outsourcing accounts payable processes can lead to significant improvements in efficiency for businesses. By leveraging the expertise and technology of a third-party provider, organizations can streamline their AP workflows and reduce the time spent on manual tasks such as data entry and invoice processing.

Improved efficiency in accounts payable processes can also lead to better cash flow management and a more strategic use of financial resources. By ensuring timely and accurate payments to vendors, businesses can avoid late payment penalties, capture early payment discounts, and maintain healthy vendor relationships, all of which contribute to a more efficient and effective financial operation.

Cost savings

One of the biggest benefits of outsourcing accounts payable processes is the potential for significant cost savings. The improved efficiency mentioned in the previous point will lead to savings in several areas, such as reduced invoice processing costs and increased vendor discounts.

Outsourcing accounts payable processes can also help organizations save on recruitment and training costs associated with hiring and maintaining an in-house AP team. By working with a specialized provider, businesses can access highly skilled professionals and advanced technology at a fraction of the cost of maintaining an internal AP department.

Enhanced visibility and control

Outsourcing accounts payable processes can also give businesses enhanced visibility and control over financial transactions. Organizations can access advanced technology and tools designed to provide real-time insights into their accounts payable operations by working with a specialized provider.

This increased visibility can enable businesses to monitor their cash flow better, identify potential issues or opportunities, and make more informed decisions related to their financial operations.

Furthermore, by working with an AP outsourcing provider, businesses can ensure that they maintain a high level of compliance with financial regulations and industry best practices.

Potential Drawbacks of Using an Accounts Payable Service

While there are many benefits to outsourcing accounts payable processes, it’s important to also consider the potential drawbacks and concerns that may arise. Below, we explain why you need to consider the following three areas and what you can do to mitigate any potential challenges.

Data privacy and security

Data privacy and security are critical concerns when outsourcing accounts payable processes. Businesses need to ensure that their sensitive financial information is protected and that their outsourcing provider has robust security measures in place to prevent fraud, hacking, skimming, check tampering, incorrect payment processing, and data breaches.

To mitigate these risks, it’s essential to thoroughly evaluate potential accounts payable outsourcing providers and ensure that they have strong internal controls and anti-fraud measures and adhere to accounting principles and regulations.

By selecting a reliable provider and implementing additional security measures, businesses can reduce the likelihood of data breaches and financial losses.

Loss of direct control

Outsourcing accounts payable processes can result in a loss of direct control over managing financial transactions and vendor relationships. Although this can free up valuable time and resources for businesses to focus on other core activities, it may also lead to a lack of oversight and increased dependency on the outsourcing provider.

To address this concern, businesses should maintain open communication and transparency with their outsourcing provider, ensuring that issues and concerns are promptly addressed and that the provider meets the organization’s expectations and requirements. By establishing clear expectations and maintaining a strong working relationship with the outsourcing provider, businesses can maintain appropriate control over their accounts payable processes.

Communication challenges

Communication challenges can arise when working with an outsourced accounts payable provider, particularly if there are language barriers, time zone differences, or lack of clarity in communication. These challenges can result in misunderstandings and delays in communication, which can adversely affect the accuracy and timeliness of services provided.

Businesses should establish clear communication channels and expectations with their outsourcing provider from the outset to address communication challenges. This may include regular progress updates, meetings, and clearly defined points of contact to ensure that any issues or concerns are promptly addressed and resolved.

Comparing Accounts Payable Outsourcing vs. Accounts Payable Automation

Businesses have two primary options for reducing the time spent on their accounts payable processes: accounts payable outsourcing or accounts payable automation. Each approach has its own advantages and disadvantages, and the right choice will depend on your organization’s specific needs and goals.

Accounts payable automation refers to implementing software solutions designed to streamline and automate accounts payable processes within your organization. Businesses can reduce manual data entry, minimize errors, and improve overall efficiency by automating tasks such as invoice receipt, processing, and payment. For example, AP automation can lead to a 49% cost savings for invoice processing.

However, accounts payable automation may not be suitable for all businesses, as it may not offer the same level of human oversight and adaptability as outsourcing accounts payable processes. Additionally, implementing accounts payable automation software may require a significant initial investment (or recurring SaaS fees) in software and training of in-house employees. Also, some organizations may prefer to retain direct (manual) control over their accounts payable operations.

So while implementing an accounts payable automation system in-house can help reduce invoice processing costs and improve efficiency, you will still have to have in-house employees dedicated to AP functions. Therefore it’s unlikely to provide the same level of cost reduction as outsourcing.

There’s no one-size-fits-all accounts payable solution. But by considering factors such as cost, scalability, and the level of control desired, you can make an informed decision about the best approach for your business.

Tips for Choosing the Right Accounts Payable Service Provider

Selecting the right accounts payable service provider is critical to ensure a successful partnership. Below are our top tips for three areas to consider when choosing the best AP outsourcing provider.

Assessing provider capabilities

When evaluating the capabilities and expertise of potential AP outsourcing providers, it’s important to consider factors such as their experience in the industry, the technology they use, and their capacity to process various types of invoices.

Asking for references and case studies can also provide valuable insights into the provider’s track record and effectiveness in managing accounts payable processes for other organizations.

Additionally, consider the provider’s ability to integrate with your existing systems and processes, as seamless integration can help ensure a smooth transition and ongoing success of your accounts payable outsourcing efforts. By thoroughly assessing a provider’s capabilities, you can select the best-fit partner for your organization and ensure that your accounts payable processes are effectively managed.

Evaluating cost and value

When assessing the cost and value of outsourcing AP services, it’s important to consider not only the upfront costs but also the long-term benefits. Factors such as cost, features, customizability, integration, support, and metrics like average cost per invoice, invoice processing time, and discounts captured versus offered should be considered when evaluating potential providers.

Don’t be swayed by the lowest price alone—it’s essential to weigh the overall value of the services provided, taking into account the provider’s expertise, technology, and potential impact on your organization’s bottom line. By carefully considering the cost and value of different accounts payable service providers, you can make an informed decision that will deliver the best return on investment for your business.

Verifying security and compliance measures

As we mentioned earlier, verifying potential AP outsourcing providers’ security and compliance measures is crucial to ensure that your organization’s sensitive financial information is protected. Evaluate the provider’s internal controls, anti-fraud measures, and adherence to accounting principles and regulations to gauge their commitment to data security and compliance.

Ask potential providers about their data privacy and security policies and any certifications or audits they may have undergone to demonstrate their commitment to safeguarding your financial information.

By confirming that a provider has robust security and compliance measures in place, you can minimize the risks associated with outsourcing accounts payable processes and protect your organization’s financial data.

Consider Hiring Outsourced Accounts Payable Talent From Latin America With Near

An alternative to outsourcing to a company specializing in accounts payable is outsourcing to an individual or team of AP professionals.

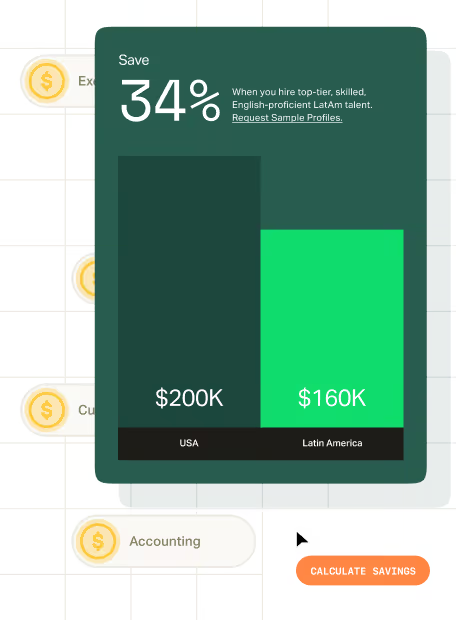

Near is a valuable resource for US companies seeking to hire remote talent from Latin America (LatAm) for their accounts payable outsourcing needs.

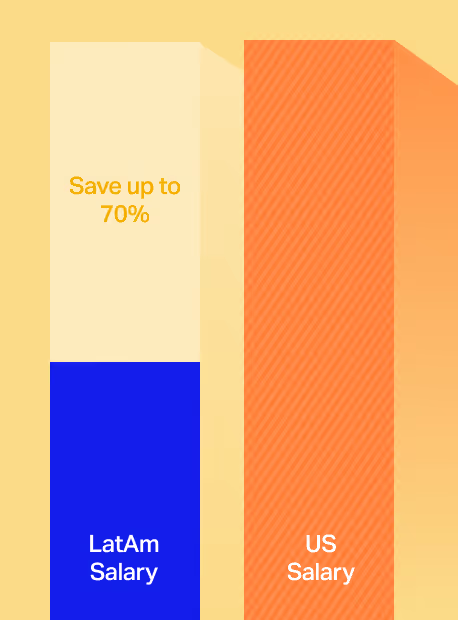

By leveraging the skilled workforce available in top accounting offshoring countries like those in the LatAm region, businesses can access top-quality accounts payable professionals at a fraction of the cost of hiring in-house staff. For example, the average salary of an accounts payable manager based in LatAm is up to 59% less than a US-based manager.

In addition to reducing operating costs, hiring outsourced accounts payable talent from LatAm through Near can provide your organization with a diverse range of expertise and experience, ensuring that your accounts payable processes are managed efficiently and effectively.

By partnering with us, you can tap into the vast pool of talented professionals in Latin America, drive growth, and increase the financial health of your company.

Final Thoughts

Accounts payable outsourcing can offer significant benefits to businesses, including cost savings, improved efficiency, and enhanced visibility and control over financial transactions. However, it’s crucial to carefully weigh the potential drawbacks and challenges, such as data privacy and security concerns, loss of direct control, and communication challenges, to ensure that outsourcing accounts payable processes is the right decision for your organization.

By evaluating potential providers’ capabilities, assessing cost and value, and verifying security and compliance measures, you can select the best accounts payable service provider for your business needs. With the right partner in place, your organization can unlock the potential of accounts payable outsourcing and drive the success of your financial operations.

If you would like to explore further how Near can help you outsource your accounts payable roles to professionals in LatAm, book a free consultation call today.

Want to know more about hiring from LatAm before hopping on a call? Read our guide on everything you need to know about nearshore outsourcing.

Frequently Asked Questions

What are accounts payable services?

Accounts payable services involve verifying vendor invoices and ensuring goods and services have been received before issuing payment to vendors, thus allowing businesses to keep track of their short-term debts in the general ledger.

This helps businesses maintain accurate financial records and ensure vendors are paid on time. It also helps businesses manage their cash flow and prevent overspending.

What is an example of an accounts payable?

An example of an accounts payable is when a company owes money to vendors for goods or services, such as transportation costs, raw materials, leasing fees, and software subscriptions. Accounts payable show the balance that has not been paid for transactions yet.

How much does it cost to outsource accounts payable?

Outsourcing accounts payable can cost between $1.40 and $2.00 per invoice, making it an efficient and cost-effective solution.

What does the accounts payable process involve?

The accounts payable process involves the recording and payment of invoices from vendors, with tasks such as maintaining the master vendor file, verifying and matching invoices, coding or uploading into a financial system, and processing payments.

It also ensures records are kept of all financial aspects of purchases made by the company.

.avif)

.avif)

%20(1).avif)

%20(1).png)