Paying international employees and contractors can be complex and full of potential pitfalls. In fact, the IRS penalizes 40% of small businesses an average of $845 for making payroll mistakes.

It’s critical to consider that the laws governing payroll and payment of workers vary from country to country. Employers need to understand these laws to ensure compliance with local regulations and avoid hefty fines or other penalties associated with non-compliance.

This article provides an overview of how to pay remote foreign workers or international contractors, as well as some essential tips and considerations to keep in mind when making payments across borders.

What To Expect With Remote Work Setup

Many companies lack the infrastructure and processes to pay their remote workers. There are also issues, such as tax regulations, that you must consider when paying remote workers. This can be a daunting task for companies, as navigating the complexities of payroll and tax laws is no easy feat.

Additionally, since remote workers are often located in different parts of the world, there can be challenges regarding currency exchange rates, payroll taxes, and employment laws. To make matters even more complicated, the legal and regulatory landscape surrounding remote work is ever-changing, making it difficult for companies to stay abreast of the latest requirements.

What Are the Main Ways To Pay Remote Workers?

As you build your remote team, it’s beneficial to know the various payment options to help ensure each worker gets paid on time and with minimal hassle.

Set up a local entity

Establishing a local entity to pay international workers from your remote team has some benefits. However, by creating a legal entity in the country you wish to hire people, you’ll have to comply with the often complex local labor laws.

Local entities are also important for tax purposes, as they help set up local bank accounts and access other financial services.

Setting up a local entity is often not your best choice to pay remote international employees or contractors for multiple reasons. For starters, if you hire employees in multiple countries, you will have to set legal entities in all of them. Furthermore, you will need to file taxes in each country, hire a local lawyer, and find a local accountant, potentially increasing your overhead.

Partner with a local company

Partnering with a local company will provide numerous advantages, including significant savings in fees, reduced administrative burden, increased speed of payments, lower exchange rates, reduced taxes, and a more streamlined payment process.

A local partner can also help ensure that the employer complies with all applicable laws and regulations related to worker compensation, local labor laws, employment benefits and more. In particular, they can help employers stay up-to-date on any changes in labor or tax regulations that could affect their international payroll needs.

The local partner can also help manage payroll services, ensuring that all payments are processed safely and securely.

Use an Employer of Record

An Employer of Record is a third-party company that employers can use to pay their international employees and remote workers. This strategic relationship allows employers to avoid the complexities of setting up in-country payrolls, withholding of income taxes, tax filings, labor laws, employee recruitment, and onboarding procedures.

The employer simply contracts with the third-party company, and they take care of the rest. They are more than your payroll partner.

This is also an excellent solution for employers looking to hire on a short-term basis or to test the waters in new markets. You can use the Employer of Record as an interim solution until you decide whether to expand your workforce into that market permanently.

Pay workers as independent contractors

If the worker is classified as an independent contractor, you will need to provide them with a contract outlining payment terms, including how often payments are made and what type of payment system is used.

Use the best payment method for both you and your contractor. Some popular categories for paying international contractors include international bank transfers, international money orders, money transfer services (such as PayPal), payroll software providers (like Deel), and cryptocurrency.

Self-employed contractors take care of their own tax returns.

Remote Worker Classifications

When it comes to remote work, there are a variety of classifications that can be applied. Some companies may classify workers as independent contractors, while others may consider them part-time or even full-time employees.

You should understand how different types of remote worker classifications are identified so you can accurately categorize and compensate your staff accordingly.

Paying local vs international remote workers

Local remote workers live and pay taxes in the same country as their employer, while international remote workers file taxes in a different country from their employer.

When it comes to paying remote local and remote international employees, there are some key differences that employers need to be aware of. Local employees generally receive their payment through direct deposit, cash, or a check. International remote workers, however, may require different payment methods entirely. Payroll frequency may also vary as some remote international employees are paid monthly or by project, whereas local remote employees are paid bi-weekly or monthly, depending on the payroll process.

Due to the exchange rate between currencies, international payments can incur additional fees and complexity. As a result, many employers use international payment services such as PayPal or Wise to pay remote employees. These services provide a more secure and cost-effective avenue of transferring money overseas, as well as a variety of currency options.

Permanent employees vs independent contractors

Permanent employees and independent contractors differ in many ways. Here’s a table summarizing their differences.

Whether to hire a permanent employee or an independent contractor should come down to what is best for your business and individual needs. Consider all the factors involved before making a final choice.

When Should You Pay Remote Workers?

There are a few factors to consider to decide when to pay remote workers:

- What type of work will they do?

- Is it project-based or recurring? For instance, is it a project-based task or something that will be ongoing? If you can break the project into milestones, you can pay them as they complete milestones. On the other hand, if it’s recurring, such as customer service tasks, you can pay them weekly or bi-weekly for the number of hours they worked.

- How long will it take them to complete the project? This can help determine when they should be paid; for example, if a task is very complex or time-consuming, consider paying them weekly or biweekly.

- What payment method will you use? Some workers prefer to be paid through direct deposit, while others may prefer PayPal payments.

- Consider your company’s payment frequency; some companies opt for monthly payments, while others pay remote workers more regularly.

Ultimately, when it comes to paying remote workers, it’s important to be fair and consistent to build trust with your team. This way, you can ensure that your remote workforce will remain productive and engaged.

How Much Should You Pay Remote Workers?

A few important considerations will influence the amount of money you offer your remote employees.

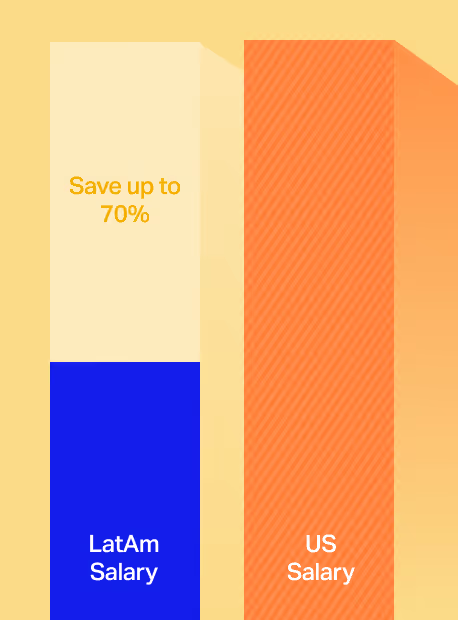

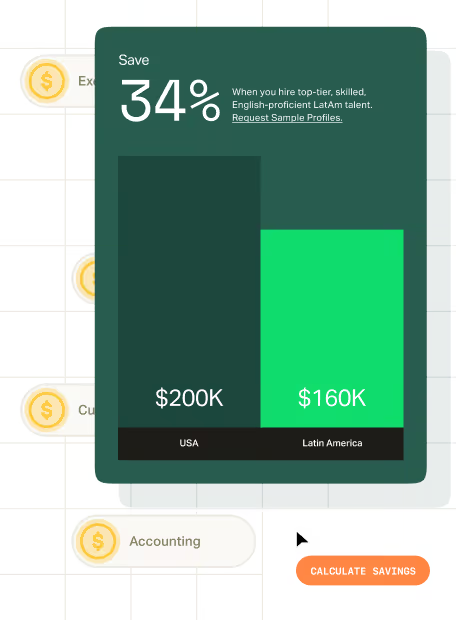

First, the location of the remote worker. Salaries in some areas can be significantly higher than in others, so you may need to adjust your budget accordingly. Consider the cost of living and the type of work they will do when determining a fair wage.

Factor in the level of experience and qualifications that the remote worker brings to the job. Naturally, a more experienced and highly skilled worker will likely command a higher salary than an inexperienced one. You should also account for any specialized skills or training that they may have to provide them with a fair wage.

Finally, weigh up the value they can bring to your organization. Remote workers can offer flexibility, cost savings, and added skills that may not be readily available in a traditional work environment. By taking these factors into account, you can ensure that you are paying your remote workers a fair wage while also getting the most value out of their unique skills and abilities.

Which Currency Should Be Used To Pay Remote Workers?

One of the main reasons why LATAM employees are interested in remote jobs is related to currency, which, in most cases, is the US dollar. USD is stronger and more stable than most currencies in Latin America.

Getting paid in USD is beneficial for remote workers as inflation is a major issue in many Latin American countries, meaning that local currency loses value every month. This is also why some LATAM residents prefer using USD or the euro when it comes to saving money.

Adjustments provided by employers are often not sufficient enough to keep up with this loss of value, so workers turn to more reliable currencies to save their money.

Remote jobs also provide a way for workers to access these currencies without having to physically relocate. This means they can still stay in their home countries but with the added benefit of saving in stronger currencies. Ultimately, remote jobs offer LATAM people a viable option for protecting their hard-earned money from inflation.

Tax-Related Matters When Paying Remote Workers

Paying remote workers can be a complex task, especially concerning tax-related matters. As an employer, you’re responsible for ensuring that all taxes are paid correctly and on time. This section will help explain what’s involved with paying taxes on behalf of remote employees and how to do it correctly.

Relevant payroll forms for remote international contractors

In the United States, hiring remote employees requires employers to collect certain forms for payroll. One key form is the W-8BEN or Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding.

This form must be filled out by any foreign individual who will receive payment from a US source, such as a salary or commission. US sourced income is understood as income for work performed inside the US, not subject to taxes for work performed offshore.

The W-8BEN form is used to ensure that the foreign individual pays the appropriate taxes in their home country, and it also helps employers avoid the need to withhold US taxes on payments they make to such individuals.

The W-8BEN form must be completed by non-US citizens who will receive income from a US source, including those who work remotely. It is important to note that this form must be completed in full, and it cannot be left blank or incomplete.

The individual providing the information on the form must provide their name, address, Social Security number (if applicable), date of birth, and any other relevant information that pertains to their status as a foreign person living outside of the US. Failure to provide this information can result in penalties or other consequences for the employer.

Income Tax for remote foreign workers and contractors

When you hire a remote contractor, it is typically not required to withhold any taxes from the contractor's pay. This is because the contractor is considered to be self-employed and is responsible for paying their own taxes. Make sure to inform the contractors you hire that they will be responsible for their own taxes in their country.

In addition to paying their own taxes, remote contractors may also be responsible for complying with any other tax-related requirements in their country, such as obtaining a tax identification number or registering for self-employment tax. It is the contractor's responsibility to familiarize themselves with the tax laws and requirements of their country and to take the necessary steps to ensure that they are in compliance. Companies hiring remote contractors should be prepared to provide guidance and support to their contractors as needed, but ultimately it is the contractors' responsibility to pay their own taxes.

Choose Between In-House Payroll vs Global Payroll Provider

Making the right decision between in-house payroll and a global payroll provider can be critical to your business operations and long-term success. Pay transparency enhances trust and compliance in international team. With more companies expanding their workforce across multiple countries, employers should consider all factors associated with managing an international payroll system.

Benefits of using a global payroll provider

Global payroll providers offer specialized services and advice on how to best approach global payroll operations.

Whether you’re dealing with multiple currencies, language barriers, or cultural differences, having a knowledgeable partner can help make the process much easier.

Some of the benefits a global payroll provider can offer include the following:

- Streamlined pay cycles – Global payroll providers are experienced in dealing with multiple currencies and different tax regulations, making managing your employee pay cycles easier. You don’t have to worry about complicated exchange rates or miscalculations, as these providers are already well-versed in global payroll regulations.

- Access to vetted experts – Global payroll providers have a network of experienced professionals who can help you navigate the complexities of paying international employees. Any questions or issues you may have will be addressed quickly and accurately, making your life much easier.

- Transparency – Global payroll providers are committed to providing a transparent and accurate process. This means you can rest assured that your employees’ pay is being managed properly and in line with international regulations.

- Cost savings – Dealing with multiple currencies, tax codes, and other regulations can be expensive, but working with a global payroll provider can help you save money in the long run. They are experts in their field and know the most cost-effective ways to manage your employee pay cycles.

How to choose which global payroll provider to use?

As an employer, remember that the global payroll provider you choose will ultimately determine how quickly and efficiently you can process payments, ensure compliance with local laws, and manage employee data.

In addition to considering cost and ease of use, there are a few other aspects you should consider when choosing a global payroll provider.

The first is the provider’s track record:

- Do they have a good reputation within the global payroll industry?

- Are they able to provide reliable and timely support when needed?

- What type of customer service do they offer?

- Have there been any major issues reported with their services in the past?

- Have they worked with international full-time remote employees?

These questions will help you determine if a provider is trustworthy and reliable.

The second aspect is the provider’s ability to integrate with your systems and processes.

- Can they easily handle complex payroll tax requirements?

- Are they able to provide a secure platform for data transfer?

- What type of reporting capabilities do they offer?

- Can they handle employee income tax?(when using an EOR)

Having a provider that can integrate seamlessly with your existing software will ensure you get the most out of your payroll system.

The third aspect is the provider’s ability to adapt to changing regulations and compliance requirements.

- Do they offer ongoing support and advice on local laws?

- Can they provide up-to-date information related to tax filing deadlines, currency exchange rates, etc.?

Having a provider always on top of the latest changes will save you time and money in the long run.

Finally, it’s vital to consider the provider’s customer service.

- Do they offer a dedicated account manager who can help answer questions?

- Are their customer service staff knowledgeable and able to provide quick responses to inquiries?

- Are they well-versed in working with international businesses like yours?

- Can they handle employment contracts for your international remote employees?

Having an accessible customer service team is essential for a stress-free payroll experience.

By considering all these factors, you can find the right global payroll provider that meets your needs and ensures that your employees are paid quickly and fairly.

Benefits of using an in-house payroll approach

An in-house payroll approach can be beneficial for paying international employees due to its flexibility. Companies can customize their payments according to the rules and regulations of each country they operate in.

Furthermore, this approach allows companies greater control over how employee payments are managed, with the ability to track payment history, assign different payment methods and easily make changes as necessary.

In-house payroll systems also offer greater security due to the fact that all employee data is stored internally, reducing the risk of external hacking or data theft.

Finally, an in-house payroll approach can reduce costs associated with third-party services and allow companies to change payment methods or policies as needed. These benefits make an in-house payroll system an excellent option for paying international employees.

Final Thoughts

Paying international employees and contractors involves a lot of considerations. It’s important to understand the legal requirements of each country, such as minimum wage laws, tax regulations, and more. Additionally, you need to be aware of the financial implications that come with making payments in foreign currencies.

Investing in the right tools and understanding the applicable laws and regulations can ensure that your international payroll processes are efficient, compliant, and cost-effective.

If you’re ready to hire foreign remote workers for your business but don’t want to have to worry about all the intricacies of paying remote international contractors, partnering with a staffing agency that can deliver you a list of pre-vetted candidates and can handle payment of contractors for you is an excellent way to grow your team. It also allows you to tap into a massive pool of candidates that you can hire for up to 70% less than a US employee and that can deliver at the same level of work quality.

If you want to get a list of pre-vetted candidates for any role you are looking for, fill out this form.

Discover why US companies should hire LatAm Talent

Check out these 9 lessons we learned hiring in Latin America

Read our Comprehensive Guide To Hiring Remote Foreign Employees

Get free access to Near's Offer Letter Generator: Create offer letters for remote hires in under 5 minutes!

.avif)

.avif)

%20(1).avif)

%20(1).png)