Looking for ways to maximize efficiency and drive growth? One solution worth exploring is finance and accounting business process outsourcing (F&A BPO). This approach allows you to delegate your finance and accounting tasks to third-party experts, freeing up valuable resources so you can focus on core business operations.

We’ll explore the growing demand for F&A BPO, essential functions to outsource, selecting the right outsourcing partner, and preparing your finance team for the transition. Whether you’re already familiar with F&A BPO or just starting to consider it, the following insights will help you make informed decisions.

What Is Business Process Outsourcing in Finance and Accounting?

F&A business process outsourcing entails delegating certain finance operations and accounting tasks to experienced external service providers. Commonly outsourced tasks include:

- Bookkeeping

- Back-office support

- Customer billing

- Invoicing

- Tax filing

- Bank reconciliation

- Financial planning

Major players in the field, such as Deloitte, EXL, IBM, Wipro, and Accenture, leverage advanced technologies like robotic process automation to deliver top-notch outsourcing solutions.

The Growing Demand for Finance & Accounting Business Process Outsourcing

The global F&A BPO market’s continued expansion signifies the growing importance of outsourcing. Many organizations pursue efficiency and cost savings through F&A BPO, transforming their finance and accounting departments and optimizing their business processes.

Partnerships with third-party service providers enable businesses to tap into global expertise, enhancing their efficiency. This has led to an increasing demand for such outsourcing solutions.

Industries like healthcare and banking are leading the charge in F&A BPO adoption.

The banking industry, for instance, has seen significant impacts, with banks achieving greater scalability and flexibility in their finance and accounting operations.

But F&A BPO is prevalent across many other sectors, including:

- Retail

- Telecom

- Hospitality

The telecom sector leverages F&A BPO to achieve financial efficiency by outsourcing non-core functions to specialized service providers. This enables telecom companies to:

- Access the expertise of these providers without costly training programs or specialist recruitment

- Enhance their financial processes

- Adopt best practices and new technologies

Why Companies Outsource Their Finance and Accounting Functions

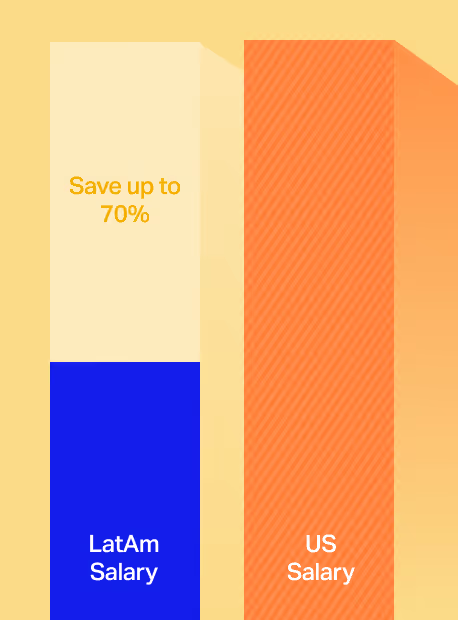

Cost reduction, access to global talent, and increased efficiency are motivating factors behind the adoption of F&A BPO. Outsourcing F&A services allows companies to:

Save time and money

Outsourcing finance and accounting tasks to experts can significantly reduce the time and resources spent on these functions, leading to considerable cost savings and better cash management.

Focus on core competencies

By delegating non-core tasks, companies can concentrate on their primary business operations, enhancing productivity and growth.

Improve financial reporting

Outsourcing providers often have specialized knowledge and advanced tools, which can lead to more accurate and efficient financial reporting.

Gain efficiency

Outsourcing repetitive and time-consuming finance and accounting tasks can streamline financial operations, improving overall efficiency in the organization.

Outsourcing gives companies the advantage of specialist expertise in finance and accounting while reducing costs and enhancing efficiency. Many businesses have experienced these advantages by outsourcing their accounting and finance functions.

Types of Finance and Accounting Tasks You Can Outsource

Typically, outsourcing finance and accounting includes functions like:

Accounts payable and receivable

Managing bills and invoices can be a complex process. Outsourcing these tasks ensures they are handled by experts, reducing errors and improving efficiency.

Payroll processing

Managing payroll requires significant attention to detail and knowledge of tax laws. Outsourcing this task can save time and ensure compliance with all relevant regulations.

Financial reporting and analysis

Preparing financial statements and conducting financial analysis requires a deep understanding of financial principles and standards. Outsourcing this function allows companies to benefit from the expertise of financial professionals.

Tax preparation and filing

Navigating tax laws can be challenging and time-consuming. Outsourcing tax preparation and filing ensures accuracy and tax compliance.

Bookkeeping

Keeping accurate financial records is essential for any business. Outsourcing bookkeeping tasks allows companies to have accurate and up-to-date financial information without the need for in-house resources.

Budgeting and financial planning

Creating and managing budgets requires time and financial expertise. Outsourcing these tasks allows companies to benefit from expert financial planning and analysis.

By outsourcing these finance and accounting functions and more, you can ensure these critical tasks are handled by experienced professionals, allowing you to focus on your core business activities.

Companies are increasingly outsourcing high-impact roles, including controllers, CFOs, and Private Equity Analysts, to streamline financial decision-making processes.

Selecting the Right Finance & Accounting Business Process Outsourcing Partner

Selecting the right F&A BPO partner is essential for finance and accounting outsourcing success. To make an informed decision, you should evaluate industry expertise, assess technological capabilities, and prioritize customer retention and satisfaction.

Evaluate industry expertise

A partner possessing specialized industry knowledge can better understand the unique needs and challenges of finance and accounting functions within a specific industry. This expertise allows them to offer tailored solutions, enhanced financial control, and ensure compliance with industry-specific regulations. Key indicators of industry expertise include:

- Industry knowledge and experience

- Longevity and track record

- Customized services

- Innovation and adoption of advanced technologies

- Strong financial control and reporting capabilities

Assess technological capabilities

A partner equipped with robust technological capabilities can offer advanced solutions like:

- Robotic process automation

- Data analytics

- Cloud computing

- Process automation

- Machine learning and cognitive intelligence

Utilizing advanced technologies in finance and accounting BPO offers several advantages, including streamlined accounting processes, faster and more accurate financial information, and automation of repetitive tasks.

Consider customer service quality

Another crucial factor when choosing a F&A BPO partner is the quality of their customer service. A provider that prioritizes customer satisfaction and is dedicated to addressing your concerns promptly and effectively can make the outsourcing experience significantly smoother. Look for a partner that offers:

- Clear and open communication: They should be able to explain complex processes in a way that’s easy to understand and be open to answering any questions you might have.

- Responsiveness: The provider should respond to your queries and concerns promptly. Delays in communication can lead to operational inefficiencies.

- Problem-solving skills: Issues may arise during the outsourcing process. A good partner will proactively identify these issues and swiftly provide solutions.

- Flexibility: The provider should be able to adapt to your business’s unique needs and be willing to customize their services accordingly.

By considering these aspects of customer service, you can ensure a productive and positive relationship with your F&A BPO provider.

If you are looking to outsource some of your accounting or finance functions to an individual professional rather than a BPO company, see our 10 effective interview questions for remote accounting and finance professionals.

Preparing To Outsource Finance and Accounting Functions

When preparing to work with a third-party company for outsourcing your finance and accounting functions, it’s important to take several steps to ensure a smooth transition.

Define clear goals and expectations

What do you hope to achieve by outsourcing your finance and accounting tasks? Is it cost savings, access to specialized expertise, or improved efficiency? Having clear objectives will guide your selection process and set the foundation for a successful partnership.

Evaluate your current processes

Next, evaluate your current finance and accounting processes, from transactional processes to cash flow management to risk management. Identify areas of inefficiency or tasks that require specialized knowledge. These are prime candidates for outsourcing.

Communicate with your team

Communication is key during this transition. Make sure your finance team understands why you’re outsourcing and how it will impact their roles. Address any concerns and reassure them of the benefits outsourcing will bring to the organization.

Train your team

Your team may need to learn new skills or tools to work effectively with the outsourcing provider. Provide the necessary training and support to help them adapt to the new arrangement.

Establish a transition plan

Finally, establish a transition plan with your outsourcing provider. This plan should detail the steps for transferring responsibilities, including timelines, roles, and responsibilities. It should also include a contingency plan in case things don’t go as planned.

By taking these steps, you can ensure your team is well-prepared for the transition to outsourcing your finance and accounting functions.

Final Thoughts

In conclusion, finance and accounting business process outsourcing presents numerous advantages if you want to maximize efficiency and reduce costs. By identifying which functions to outsource, selecting the right partner, and preparing for the transition, you can unlock the full potential of finance and accounting outsourcing.

Embrace F&A BPO solutions and watch your organization thrive with improved efficiency, cost savings, and more strategic finance operations.

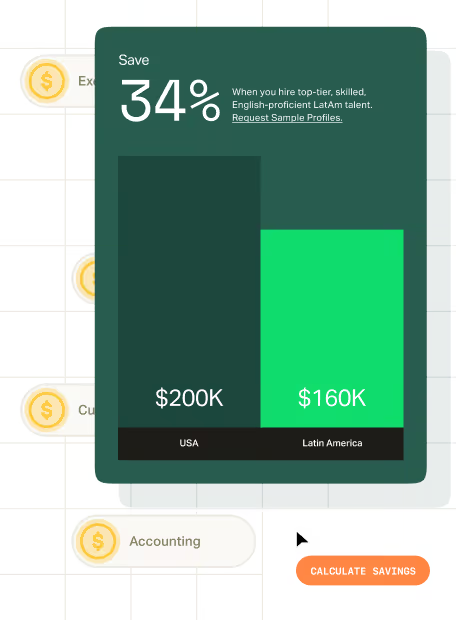

However, the success of your F&A BPO largely depends on the talent you hire. This is where Near comes in. Near helps US businesses hire top finance and accounting talent in Latin America, ensuring that your outsourced finance and accounting tasks are handled by the best in the field.

Ready to take the next step toward financial efficiency and growth? Book a complimentary call with Near today, and let us show you how we can help your business reach new heights with our top-tier talent solutions.

Frequently Asked Questions

What are the potential risks of finance and accounting business process outsourcing?

While F&A BPO has many benefits, it also comes with potential risks, such as loss of control over outsourced functions, potential for reduced quality of work, and potential security issues with sensitive financial data.

It’s essential to choose a reputable outsourcing partner and have solid contracts and clear communication to manage these risks effectively.

What is the impact of F&A BPO on in-house employees?

The impact of F&A BPO on in-house employees can vary. In some cases, employees may need to be retrained to manage the relationship with the outsourcing partner or take on new company roles. In other cases, outsourcing may lead to job losses.

However, it can also free up in-house staff to focus on more strategic, value-added tasks, potentially leading to higher job satisfaction.

How do you measure the success of an F&A BPO partnership?

The success of an F&A BPO partnership can be measured in several ways, depending on the goals of the outsourcing initiative. Some common metrics include:

- cost savings

- increased efficiency

- improved accuracy in financial reporting

- higher employee productivity

Additionally, customer satisfaction and the ability to focus more on core business areas can also indicate a successful outsourcing partnership.

.avif)

.avif)

%20(1).avif)

%20(1).png)