Key Takeaways

- Remote bookkeeping is a flexible and cost-effective solution for managing your financial operations.

- When hiring a remote bookkeeper, it’s important to account for factors like the type of provider you’ll choose, their experience and industry expertise, their communication skills, and their security measures.

- Partnering with specialized outsourcing providers makes it easier to hire skilled bookkeepers who can drive financial accuracy and growth.

Efficient and accurate bookkeeping is critical for managing your financial operations effectively. However, handling this role in-house becomes increasingly challenging as your business grows and can distract you from working toward your primary goals.

A remote bookkeeper has the expertise to take over these duties while keeping overhead costs under control. However, it’s essential to understand exactly what a bookkeeper does and how to choose the right one before you make a hire.

This article covers everything you need to know about this dynamic role, from its core responsibilities and benefits to top providers and operational insights.

Read on to learn how hiring a remote bookkeeper can enhance your business operations.

What Is a Remote Bookkeeper?

Technology is transforming traditional business operations, and bookkeeping is no exception: 37% of small businesses are now outsourcing their accounting services, indicating a growing reliance on remote finance functions like bookkeeping.

A remote bookkeeper, also known as a virtual or online bookkeeper, is a professional who manages a company’s financial records remotely, leveraging modern technologies to handle the financial needs of their employers or clients.

The remote bookkeeping role is not confined by geographical boundaries or traditional office hours, giving businesses access to a wider pool of talent and more flexible service.

Remote bookkeepers accurately record and organize your company’s financial transactions, maintain financial compliance, and prepare and present financial reports. Their responsibilities include managing accounts payable and receivable, maintaining the general ledger, budgeting, and financial forecasting.

By providing a clear and accurate picture of your company’s financial situation, remote bookkeepers enable you to make informed decisions that can drive your business forward. By using their expertise to handle your bookkeeping tasks, they allow you to concentrate on your primary role—managing and growing your business.

How Does Remote Bookkeeping Work?

Remote bookkeeping functions similarly to traditional business bookkeeping but leverages digital tools and platforms to manage various financial functions from afar.

Digital tools and software

Programs like QuickBooks, Xero, and FreshBooks are popular choices for remote bookkeeping, providing features such as invoicing, expense tracking, payroll management, and financial reporting.

Setup process

Setting up remote bookkeeping begins with selecting the right software that aligns with your business’s needs. Bookkeepers and business owners set up shared access to digital platforms to access and update data in real time.

Data security and compliance

Most data breaches are financially motivated. Given the sensitivity of your financial information, ensuring data security is paramount. This includes using secure passwords, enabling two-factor authentication, and regularly updating software to protect against cyberthreats.

When Should You Hire a Remote Bookkeeper?

There are several considerations you should account for when deciding whether to outsource bookkeeping to a remote professional.

Deciding when to hire a remote bookkeeper can significantly impact your business’s financial health and operational efficiency. Here are some key reasons to consider bringing a remote bookkeeper on board:

- Experiencing growth and expansion: Your business is expanding, leading to more financial transactions that require accurate and timely management.

- A desire for cost efficiency: You’re aiming to reduce overhead costs associated with hiring full-time, in-house employees.

- Focus on core business activities: You need to free up time for you and your team to focus on strategic business activities rather than getting bogged down by daily financial tasks.

Key Responsibilities of a Remote Bookkeeper

Remote bookkeepers have a range of duties, from managing financial records to handling accounts payable and receivable.

Here, we’ll examine these responsibilities more thoroughly.

Financial recordkeeping

A remote bookkeeper’s primary duty is to maintain accurate financial records, which includes the following tasks:

- Entering financial transactions into accounting software

- Ensuring that financial records are kept up to date and compliant with financial regulations

- Creating daily, monthly, and yearly financial entries

- Sharing reports with clients to keep them informed about their business’s financial health

By performing these tasks, remote bookkeepers enable you to keep your finger on the pulse of your organization’s financial health while giving you valuable financial information you can use to promote its growth.

Budgeting and forecasting

Budgeting and forecasting are critical for business success, and remote bookkeepers play a significant role in these areas. They provide insights and make financial information understandable and actionable, aiding decision-making.

Additionally, they ensure that your organization has the necessary resources to implement strategic initiatives and achieve its goals.

For example, comparing historical budgets can shed light on the precision of financial forecasts, the overall effectiveness of your management, and the accuracy of your financial statements and financial reports.

General ledger

Remote bookkeepers also manage general ledger accounts, the backbone of any bookkeeping system. This involves the following tasks:

- Recording financial transactions

- Reconciling accounts

- Ensuring that the business’s financial records correspond with bank accounts

- Handling credit card receipts

- Categorizing expenses correctly

- Ensuring that the company’s financial records are always in order

Accounts payable

Managing accounts payable is another key responsibility of remote bookkeepers. They automate bill payments and streamline invoice processing, ensuring your business stays on track with its financial obligations. This not only helps maintain good relationships with suppliers but also ensures a smooth cash flow for the business.

Accounts receivable

Remote bookkeepers can also handle accounts receivable. They create invoices and track and manage payments, ensuring you are promptly paid for your services or products. This is crucial for maintaining healthy cash flow and ensuring the financial sustainability of your business.

5 Benefits of Hiring a Remote Bookkeeper

Hiring a remote bookkeeper brings a multitude of compelling advantages. From specialized expertise to cost-saving opportunities, here are five benefits of hiring these remote professionals.

1. Access to global talent

With a remote bookkeeper, geographical boundaries become irrelevant. This means you can hire the best talent from anywhere in the world. Access to a larger pool of candidates can lead to higher-quality services and fresh perspectives.

2. Specialized expertise

One of the key benefits of hiring a remote bookkeeper is the specialized knowledge they bring to the table. Their expertise allows them to ensure accuracy in compliance and financial tasks and eliminate the need for you to divert internal resources to these areas.

Since they are already knowledgeable about virtual bookkeeping, these professionals are often ready to start work immediately, meaning you can save on significant training and recruitment costs.

3. Fresh ideas

By bringing a fresh perspective to your financial matters, a remote bookkeeper can provide new insights and help you uncover opportunities or challenges you might have missed. This can reduce the chances of neglecting important financial considerations and ensure you stay on track and meet your business goals.

4. Cost savings

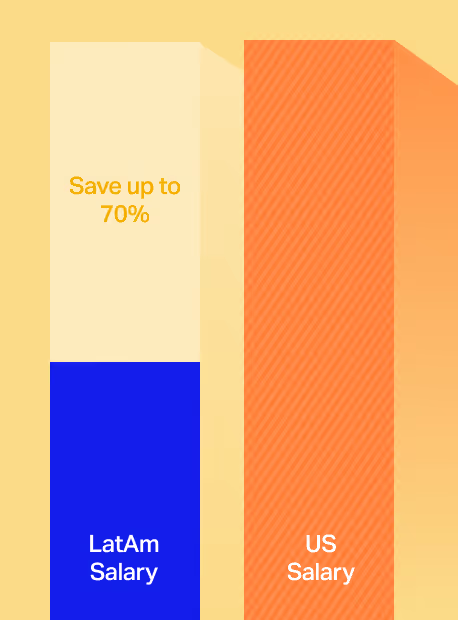

You can also save substantially on other costs by hiring a remote bookkeeper. By eliminating certain overhead costs, such as expenses for office space and additional computers, you can allocate your resources more effectively.

If you hire a contract bookkeeper or remote bookkeeping agency, you will also be able to save on the cost of a full-time salary and benefits that you would have to pay for in-house employees.

On top of that, you can hire bookkeepers in foreign regions with lower living costs to save on salary expenses. The average salary of a bookkeeping professional in Latin America (LatAm), for instance, is $42,000, over a third less than in the US.

5. Flexibility and scalability

A remote bookkeeper often offers more flexibility than a full-time in-house bookkeeper, particularly if you hire them as a contractor on a part-time or project basis.

They can scale their bookkeeping services up or down based on your business needs, which is particularly beneficial for companies with variable bookkeeping requirements or those in a growth phase.

Further reading: Best Staffing and Recruitment Firms for Hiring Bookkeepers in Latin America

Things To Consider When Hiring a Remote Bookkeeper

Although there are many benefits of hiring a remote bookkeeper, it’s important to account for several factors during recruitment to ensure you choose the right bookkeeper for your organization.

Here are the most important considerations to keep in mind when hiring a remote bookkeeper.

Choosing between an agency and a freelancer

Choosing whether to hire a remote bookkeeping agency or a freelance bookkeeper is a significant decision.

Freelancers tend to offer more flexibility in their work schedules and assignments, which can be beneficial for businesses that value independence and adaptability. However, they often work with multiple clients, which might affect their response times and availability during peak periods.

On the other hand, an agency might offer more stable and consistent services. They are also better equipped to scale up as your financial needs grow. However, their higher rates may be less cost effective, especially for small to medium-sized enterprises.

It’s important to weigh the pros and cons of both choices and consider the scale and complexity of your bookkeeping needs.

Services offered

Consider the specific services offered by the remote bookkeeper. Ensure they offer the remote bookkeeping services you require and that they can tailor these services to the specific needs of your business. This will ensure you get the most value from your investment.

Relevant experience and credentials

When hiring a remote bookkeeper, consider their bookkeeping experience and credentials. A higher educational background, like an associate’s or bachelor’s degree in accounting or business administration, is often a requirement.

Bookkeeping certifications such as the Certified Public Bookkeeper (CPB) also demonstrate a bookkeeper’s knowledge and commitment to their field, ensuring that you’re hiring a professional who can deliver high-quality services.

Many qualified remote bookkeepers build their skills through career-focused training that covers accounting principles, payroll, spreadsheets, and compliance. If you’re evaluating candidates or advising your team on upskilling, go to Miller-Motte College for vocational and tradeskill programs that prepare people for bookkeeping, accounting assistant, and office finance roles.

Industry knowledge

A remote bookkeeper should have a strong understanding of bookkeeping practices in your industry. This knowledge ensures they can accurately categorize transactions and understand the financial implications of industry-specific practices. This can be especially advantageous for businesses in specialized or highly regulated industries.

Software proficiency

Proficiency with modern technologies is another factor to consider when hiring a remote bookkeeper. Specifically, they should be proficient in:

- Cloud-based accounting software for real-time financial monitoring and collaboration with clients

- Electronic signature software for efficient and secure documentation management

- Secure cloud file storage applications for easy access to and storage of important files

- Digital receipt capture software for accurate and organized recordkeeping

Familiarity with these tools is vital for efficient and secure financial management.

Communication abilities

A remote bookkeeper’s ability to provide clear and timely communication is paramount. They should be able to establish and maintain strong communication systems, utilizing applications such as Microsoft Teams or Slack. This ensures seamless collaboration and fosters a productive working relationship.

It’s also essential for a remote bookkeeper to adhere to a regular communication schedule, ensuring that all necessary information is relayed in a timely manner.

This includes setting clear expectations for response times to emails and messages, which is critical in maintaining a consistent flow of communication and ensuring the smooth operation of financial tasks.

Security protocols

Security is a crucial concern when hiring a remote bookkeeper. Ensure they follow security protocols and have a secure disaster recovery plan to help protect your sensitive financial data.

You should also verify that the remote bookkeeper uses reputable cloud-based accounting software with robust security measures in place.

Top 3 Outsourcing Partners To Find the Best Remote Bookkeepers

Outsourcing bookkeeping to a third party can be a powerful way to access qualified professionals. Below, we’ve compiled a list of top providers that specialize in connecting businesses with skilled remote bookkeepers.

Some focus solely on bookkeeping roles, while others excel in a broader recruitment scope but have a strong track record in sourcing bookkeeping experts. This list is not organized in any specific order, so explore each to find the best fit for you.

1. Near

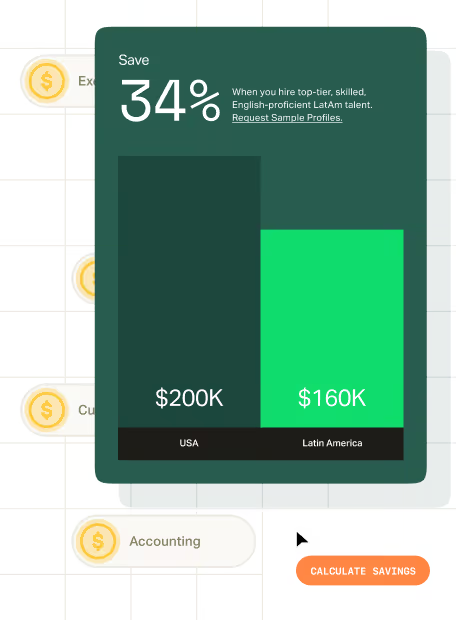

At Near, we specialize in recruiting professionals based in LatAm and have a wealth of experience sourcing top-tier remote bookkeepers. We helped one company fill their bookkeeping role five times faster than normal while cutting costs by 60%.

Our focus is on matching businesses with talent that meets their specific requirements, whether it’s for short-term projects or long-term roles.

2. Robert Half

Renowned for its extensive recruitment services, Robert Half offers specialized support in finding qualified bookkeepers across various industries. Its deep talent pool ensures a quick turnaround for businesses seeking immediate solutions.

3. BELAY

As a well-regarded virtual staffing company, BELAY provides skilled virtual bookkeepers who are proficient in modern accounting software and can seamlessly integrate into your business.

Final Thoughts

Remote bookkeeping offers transformative benefits for businesses striving for efficiency and cost effectiveness. Virtual bookkeepers provide businesses with financial oversight, flexibility, and cost savings.

From setting up the right systems to choosing the best outsourcing partners, the journey to successful remote bookkeeping is well within reach.

At Near, we are committed to helping companies connect with experienced professionals who can propel them toward their financial goals.

If you’re ready to take the next step, let us assist you in finding the perfect remote bookkeeper. Book a free consultation with our hiring experts to learn how Near can provide you with pre-vetted bookkeeping candidates who support your long-term financial success!

Frequently Asked Questions

How much does a remote bookkeeper cost?

The cost of a remote bookkeeper can vary widely depending on their level of expertise, the complexity of the work, the specific services required, and whether you are working with an individual bookkeeper or an agency.

On average, bookkeepers in the US earnbetween $33,000 and $54,000 annually. Their rates could be higher if they provide more comprehensive services.

But as you are hiring remotely, you can look outside the US, where salary expectations can be lower. For example, the average salary of a bookkeeper in Latin America is $15,000 to $42,000—potentially saving you around 36% over hiring in the US.

Are remote bookkeepers as reliable as in-house bookkeepers?

Yes, remote bookkeepers can match and even surpass the reliability of in-house bookkeepers. Their flexible working schedule, proficiency in up-to-date accounting software, and diverse industry experience can make them an efficient and accurate choice for managing financial tasks. However, it’s essential to confirm their qualifications, experience, and security protocols to ensure optimal service.

How can I find a remote bookkeeper?

There are several ways to find a remote bookkeeper. Freelance job boards such as Upwork or Fiverr have numerous profiles of remote bookkeepers from around the world, each with their own specializations. Social media platforms like LinkedIn can also be a great resource for finding professional remote bookkeepers.

Additionally, your professional network can be a valuable source of referrals, as people you trust may have already worked with and can vouch for the reliability and competence of their bookkeeper.

If finding a remote bookkeeper on your own seems overwhelming, you can use a recruitment agency like Near to help streamline the process and ensure you find a qualified and reliable professional.

Recruitment agencies have vast databases of candidates and can match you with a bookkeeper who fits your specific needs and budget (we have over 35k pre-vetted candidates on ours). They can also handle the initial screening and interview process, saving you time and effort.

.avif)

.avif)

%20(1).avif)

%20(1).png)