Key Takeaways

- Fund accounting is a complicated process prone to error because of regulations, time constraints, and multiple funding sources.

- Many private groups outsource because they save time and money while gaining expertise and increased accuracy.

- Your outsourced fund accounting partner should fit your group’s needs for services, experience, security, and price, with companies like Near, MUFG Investor Services, and SEI being top choices.

Your nonprofit is drowning in compliance requirements across multiple grant sources, and your current accounting staff is struggling to keep up with fund restrictions and reporting deadlines.

Each funding source has different rules, timelines, and documentation needs. The more you fall behind, the more you risk losing funding or facing audit penalties that could devastate your organization's reputation and future grant opportunities.

This guide covers the benefits of fund accounting outsourcing, key factors for choosing the right partner, and 15 top companies that can help you manage complex fund accounting while staying compliant and focused on your mission.

What Makes Fund Accounting Challenging?

Fund accounting is not something anyone can do. It presents plenty of challenges, such as:

- Complex regulations and compliance requirements: Fund accounting involves managing finances for specific purposes, often requiring adherence to strict regulations and reporting standards, like the International Financial Reporting Standards (IFRS) and the Investment Company Act of 1940.

- Multiple funding sources: Nonprofits and government agencies often receive funding from various sources, making it challenging to track and allocate funds accurately.

- The need for specialized knowledge and skills: Fund accounting requires specialized expertise in areas like financial reporting, budgeting, and grant management. Many organizations struggle to find and retain staff with these skills or afford their high salaries.

- Time-consuming processes: Managing fund accounting functions in-house can be time-consuming, taking away valuable resources from other important tasks.

- Risk of errors and fraud: With complex processes and multiple funding sources, there is a higher risk of errors or fraudulent activities if fund accounting is not managed properly.

Why Do Nonprofits and Private Equity Funds Outsource Fund Accounting?

Fund finance and accounting outsourcing offers several benefits for employers.

Cost efficiency

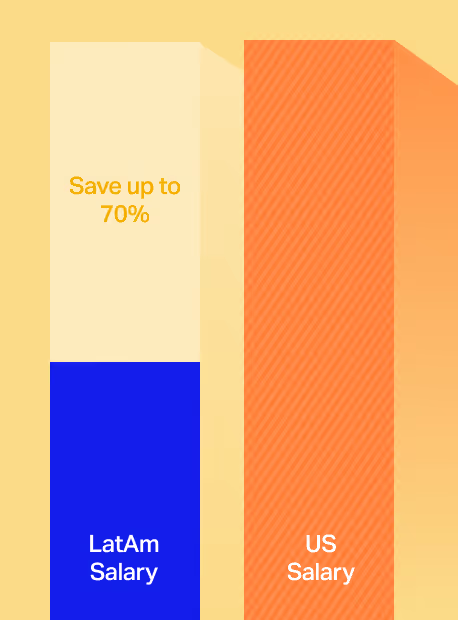

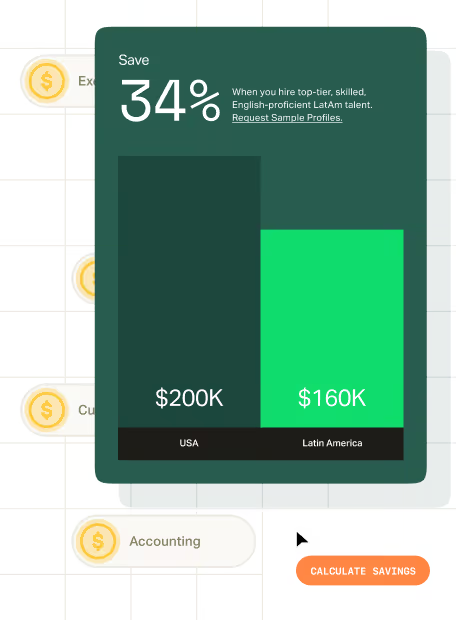

Outsourcing can significantly reduce labor costs, as you don’t have to hire and train in-house staff. Outsourcing providers often have lower overhead expenses, allowing them to offer more competitive rates, even when they help you hire.

This is especially true when outsourcing to regions with lower salary expectations, such as Latin America (LatAm).

Expertise and specialized knowledge

Fund accounting requires specialized knowledge and skills, which may not be available in-house. Outsourcing to a company specializing in this field ensures that the work is done correctly and efficiently.

Increased accuracy and efficiency

Outsourcing providers have dedicated fund accounting teams and advanced technology to handle fund accounting tasks, resulting in increased efficiency and accuracy.

Focus on core competencies

By outsourcing fund accounting, you can free up time to focus on core business activities and leave the financial management to experts. This can lead to better overall performance and business growth for your organization.

Further reading: What Smart Companies in America Are Doing to Overcome the Accounting Talent Shortage

What To Consider When Choosing an Outsourced Fund Accounting Partner

When searching for an outsourcing partner for fund accounting, there are several key factors to consider:

Experience and reputation

Choose a provider with a proven track record in fund accounting outsourcing and a strong reputation within the industry. This will ensure that they have the necessary expertise and knowledge to handle your organization’s specific needs.

Range of services offered

Aside from fund accounting, what other services does the outsourcing company offer? It’s beneficial to choose a partner that can provide a comprehensive range of services, such as tax compliance and preparation, financial reporting, and cash management.

This will save you the time and effort that would be required to coordinate with multiple providers.

Security and data protection

Fund accounting involves sensitive financial information, so it’s crucial to choose a partner with robust security measures in place. Ask about their data protection policies and procedures to ensure the safety of your organization’s data.

Pricing and contracts

Consider the pricing structure and contract terms offered by potential outsourcing partners. It’s important to have a clear understanding of the costs involved, any additional fees, and the length of the contract before signing an agreement.

Client testimonials and references

Take the time to read client testimonials and ask for references from past or current clients. This will give you valuable insights into their experience working with the outsourcing provider and their level of satisfaction with their services.

Top 15 Companies for Outsourcing Fund Accounting

Because it is a relatively niche service, fund accounting professionals can be difficult to find on your own. To help, we’ve put together a list of 15 top finance and accounting outsourcing companies with a strong track record of fund accounting services.

The list is in no particular order and includes both fund accounting-specific firms and broader recruitment agencies with experience connecting US businesses with outsourced fund accounting talent.

1. Near

Near (Hire With Near) is a full-service staffing and recruiting agency that helps US companies of all sizes hire top-performing remote talent in Latin America across finance, accounting, sales, software engineering, AI, data, marketing, operations, and virtual assistance.

We specialize in connecting organizations with skilled accountants in Latin America who understand complex regulatory requirements and can work seamlessly within your existing processes.

By hiring Latin American accounting talent, you get real-time collaboration from overlapping time zones, allowing for immediate responses to urgent compliance questions and reporting deadlines.

- Done-for-you hiring process: Candidate lists within 3 days, placements completed under 3 weeks

- Access to specialized talent: Fund accounting professionals with nonprofit and private equity experience, including those with Big Four backgrounds

- No upfront costs: Pay only after you make a hire, with choice between one-off fee or monthly fee for payroll and compliance support

- Proven success: 97% placement success rate, 9.1+ client satisfaction score, and 4.9 out of 5 rated on G2

- Comprehensive talent search: Pre-vetted pool of 45,000+ candidates, plus custom searches to find talent meeting your exact requirements

CyberFortress saved over $1.2M annually by building their 20-person accounting team through Near, including senior-level fund accounting expertise that helped streamline their financial operations and improve reporting timelines.

2. KMK

KMK & Associates LLP provides accounting and tax preparation outsourcing solutions for US-based CPA firms. It offers end-to-end outsourced fund accounting services to ensure timely reporting and regulatory compliance.

3. Phoenix American

Phoenix American offers fund administration, investor relations, and technology for private equity and venture capital funds. Its fund accounting services ensure accuracy, consistency, and compliance while keeping the needs of every audience in mind.

4. Acuity Knowledge Partners (KP)

Acuity KP handles private equity and venture capital portfolio management and fund operations. It predominantly offers support in portfolio management and portfolio operations.

5. PKF O’Connor Davies

PKF O’Connor Davies has a team of accountants and advisors offering outsourced portfolio company accounting services. This includes working with private equity funds and their portfolio companies.

6. Vistra

Vistra is an outsourcing company offering corporate, private client, and fund solutions. Included among its fund solutions is fund accounting, which includes a period-end process that helps ensure clients meet their deadlines.

7. CliftonLarsonAllen (CLA)

CLA serves businesses in a variety of industries, taking responsibility for their financial operations, including fund administration. Its experienced team of professionals helps firms navigate the complex world of fund management and investor relations.

8. Armanino

Armanino offers fund administration services for the private equity and real estate sectors. Its fund administrators help track your portfolio, organize capital calls and distributions, track your portfolio, and secure your investor information.

9. Sunibel

Sunibel Corporate Services Ltd provides comprehensive fund accounting services to investment funds. Its accountants perform net asset value (NAV) calculations and prepare IFRS-compliant financial statements for investors and regulators.

10. SEI

SEI offers businesses technology, operations, and asset management solutions, including fund administration and back-office services. According to its website, SEI believes that “with the right technologies, expertise, and thoughtful systems design, forward-looking managers can turn their back office into a competitive advantage.”

11. Reliant

Reliant Fund Services provides outsourced fund administration with the same level of attention as an in-house team. It offers bookkeeping, financial reporting, and treasury administration services while adhering to GAAP and the terms of the respective legal agreements.

12. IQ-EQ

IQ-EQ offers external CFO services and has experience with alternative assets and corporate services. Its high-quality services include fund management, finance, compliance, and accounting.

13. Cambridge Advisers

Cambridge Advisers Pte Ltd is a regulatory compliance and corporate services firm specializing in outsourcing from Singapore. It provides comprehensive fund administration services tailored for venture capital and private equity funds.

14. Trident Trust

Trident Trust offers various fund administration services for hedge funds, venture capital, and private equity. Its team of experienced professionals blends technological innovation with comprehensive industry knowledge to provide accurate, timely, and compliant fund accounting solutions.

15. MUFG Investor Services

MUFG Investor Services delivers everything from middle-office outsourcing to fund administration, risk management, and compliance. It specializes in servicing a wide range of fund types, including private equity, real assets, and hedge funds, providing robust and flexible accounting solutions tailored to clients’ needs.

Final Thoughts

Effective fund accounting requires specialized expertise that many organizations struggle to maintain in-house while managing costs and compliance requirements.

Whether you choose traditional outsourcing or hiring your own dedicated accountants, the key is finding partners who understand your specific regulatory environment and can provide the accuracy and transparency your stakeholders expect.

At Near, we understand that fund accounting professionals need deep expertise in complex compliance requirements combined with the reliability to meet critical reporting deadlines.

Our Latin American talent pool includes professionals with nonprofit, private equity, and government fund experience who can integrate seamlessly into your existing processes.

Ready to explore your options? Schedule a free, no-commitment consultation call to get salary benchmarks and understand our process.

.webp)

.avif)

%20(1).avif)

%20(1).png)