Key Takeaways

- Outsourcing finance and accounting tasks can lead to significant cost savings, enhanced expertise, and greater operational efficiency, enabling you to focus on core business functions.

- By leveraging advanced technology and ensuring compliance with accounting standards, top outsourced service providers can offer real-time financial insights and strategic planning support for business growth.

- Choosing the right outsourcing partner involves understanding your specific needs, evaluating its expertise and technology platforms, and ensuring it can scale solutions to support your business’s expansion goals.

Keeping up with constant changes in technology, regulations, or market trends can feel overwhelming, especially as you try to manage your company’s financial health.

Your internal systems need constant updates, procedures require refinement, and team members routinely move on and need replacements. This continuous cycle of adaptation and improvement can strain your resources and distract from your core business goals.

There’s a smarter way to future-proof your business. Outsourced finance and accounting services can provide the expertise, scalability, and innovation needed to stay ahead of the curve. They can help ensure your financial operations are always optimized, compliant, and ready to adapt to any challenge.

This article will explore the benefits of outsourcing, some common accounting and finance functions you can delegate, and tips on choosing the right partner. We’ll also detail five outsourced finance and accounting service providers with solid reputations.

Benefits of Outsourcing Finance and Accounting Tasks

Outsourcing your finance and accounting tasks can transform your business operations in several ways. Here are just a few of the key benefits:

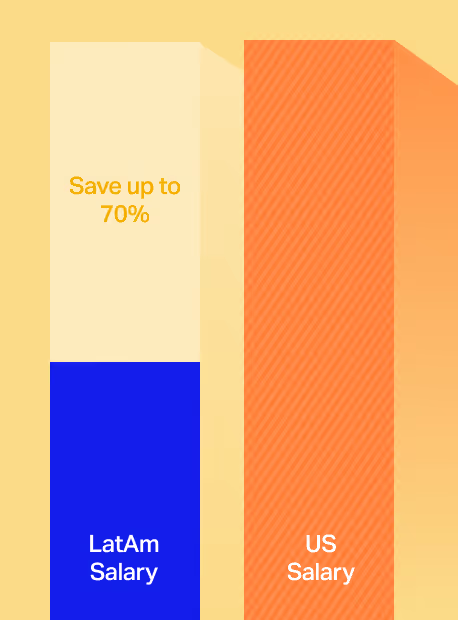

Cost savings

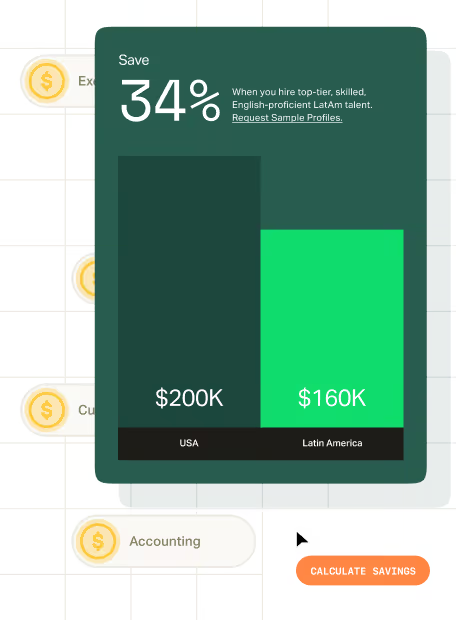

By partnering with a specialized provider, you can eliminate many expenses associated with maintaining an in-house accounting team, including benefits and training. Salary expectations are also more affordable in many popular outsourcing regions, like Latin America (LatAm), where the cost of living is much lower.

Expertise and efficiency

Outsourced accounting experts are trained on the latest tools and technologies and are well versed in navigating changing regulations and industry standards. They can quickly identify inefficiencies, implement best practices, and provide high-quality financial insights, all contributing to more effective and efficient operations.

Focus on core business functions

When you outsource finance and accounting services, you free up valuable time and resources within your organization. By offloading non-core activities, you can dedicate more effort to driving innovation, delivering exceptional customer experiences and achieving your strategic goals.

Scalability

Outsourced finance service providers offer scalable solutions that can adapt to your changing requirements. Whether you need additional support during peak times or wish to expand your accounting operations as your company grows, they can seamlessly scale their services to match your needs.

Common Outsourced Finance and Accounting Functions

More than 90% of senior managers find it difficult to find skilled finance and accounting talent, leading them to outsource a wide range of finance functions. Here are some of the most common:

- Bookkeeping and preparation of financial statements: Accurate bookkeeping is the backbone of any robust accounting system. Outsourcing ensures meticulous recording of your financial data and accurate preparation of financial statements.

- Cash flow management: By outsourcing, you gain access to experts who can monitor, analyze, and optimize your cash flow, ensuring you always have sufficient liquidity.

- Accounts payable and accounts receivable: Managing invoices, payments, and collections can be time-consuming and complex. Outsourcing streamlines these financial processes, reducing errors and improving cash flow.

- Risk mitigation and compliance: Financial regulations are complicated and always changing. Outsourcing providers keep up to date with the latest legislative changes and implement strategies to mitigate risk.

- Financial planning and strategic insight: Access to expert advice can significantly impact your business’s future. Outsourced finance and accounting professionals can offer valuable insights and strategic planning services, driving growth and profitability.

Outsourcing these functions gives you access to finance and accounting expertise and resources that might otherwise be unaffordable or unavailable.

How To Choose the Right Outsourced Finance and Accounting Provider

Selecting the right outsourced finance and accounting provider requires careful inspection and a patient approach. Here are some tips on how to find the best partner:

Understand your business needs

Before you start your search, clearly define what you hope to achieve by outsourcing. Are you looking for basic bookkeeping services or more advanced financial planning and strategic advice?

Evaluate technical expertise and industry knowledge

Look for providers with a proven track record in your industry and those who employ certified professionals with up-to-date knowledge of accounting principles and practices.

Assess the provider’s technology platforms

The right technology can dramatically enhance the efficiency and accuracy of your financial operations. Ensure the provider uses state-of-the-art tools that integrate with your existing systems and come with robust security features to protect sensitive data.

Check for compliance with accounting standards

Compliance with accounting standards and regulations is non-negotiable. Verify the provider adheres to relevant standards like:

- GAAP (Generally Accepted Accounting Principles)

- IFRA (International Financial Reporting Standards)

Additionally, inquire about its processes for staying current with regulatory changes to ensure your business remains compliant.

How Outsourced Finance and Accounting Services Can Help Business Growth

Offshoring accounting tasks is about more than just cost savings. It can act as a catalyst for growth, fueling innovation and product design. Here’s how:

Real-time visibility into financial health

Real-time access to your financial data helps you make timely and informed decisions. Outsourced services provide up-to-date financial reports and insights, allowing you to monitor financial health, identify trends, and respond to challenges.

Access to a wide range of financial solutions

Accounting outsourcing providers often offer several financial services under one roof, from bookkeeping and payroll to advanced analytics. This broad spectrum of expertise can help you address various financial needs without coordinating multiple in-house teams.

Strategic planning and informed business decisions

Experienced outsourced finance professionals can help you develop plans, set realistic budgets, and forecast future performance. With their guidance, you can make informed decisions that align with your long-term goals and capitalize on growth opportunities, while also keeping broader capital allocation and long-term asset strategies in view through firms like Abacus.

Financial statement preparation and audience readiness

Accurate and timely financial statements are required by various stakeholders, including investors, creditors, and regulatory bodies.

Outsourcing the meticulous, timely preparation of these documents helps boost your credibility and trust, making it easier to secure funding, negotiate terms, and build stronger business relationships.

Expansion into new markets

Entering new markets presents both opportunities and challenges. Outsourced providers often have the global expertise and local knowledge to help you navigate new territories successfully.

For example, if you plan to expand into LatAm, a company like Near can help secure office space, equipment, and local resources with on-the-ground support—while also handling the financial regulations and nuances of the new market.

An Alternative to Outsourcing: Building Your Own Finance Team in Latin America

If cost savings are your primary motivation for considering outsourcing, there's another approach worth exploring: hiring your own finance and accounting professionals from Latin America.

Here's the reality many companies discover: for roughly the same cost as outsourcing your entire finance function to a traditional provider, you can often hire multiple dedicated finance professionals who work exclusively for your company.

According to Near's State of LatAm Hiring Report, finance and accounting roles are the most popular positions to fill with Latin American talent, with companies typically saving $35,000 to $55,000 on these roles compared to US-based hires

This approach gives you several advantages over traditional outsourcing:

- Direct control and oversight: Your finance team reports directly to you, not to an outsourcing provider managing multiple clients

- Cultural integration: Team members become part of your company culture and understand your specific business needs

- Real-time collaboration: Latin American professionals work in time zones that overlap with US business hours, enabling seamless communication

- Long-term retention: Our data shows companies retain LatAm talent 66.29% longer than US hires, reducing turnover costs and knowledge loss

- Scalable growth: As your business grows, you can easily add more team members without renegotiating outsourcing contracts

For example, instead of paying $5,000-$7,000 monthly to outsource basic bookkeeping and financial reporting, you might hire a dedicated staff accountant and bookkeeper in Latin America for a similar total cost—giving you a full-time team focused solely on your business.

Companies like CyberFortress chose this path, building an entire 20-person accounting team through Near and saving over $1.2M annually while actually improving their operations: faster month-end closes, better reporting, and a team that stays with the company long-term.

If you're considering outsourcing primarily for cost reasons, it's worth exploring whether building your own Latin American finance team might deliver better value and control for your investment.

Top 5 Outsourced Finance and Accounting Service Providers

To help you start your search, we’ve put together a list of five top-notch finance and accounting outsourcing firms (in no particular order) that have consistently delivered exceptional services. We’ve also included a recruitment option for building your own team. Not every company is accounting-specific, but each has a proven track record of providing outsourced financial services.

1. Near

Near (Hire With Near) is a full-service staffing and recruiting agency that helps US companies of all sizes hire top-performing remote talent in Latin America across finance, accounting, sales, software engineering, AI, data, design, marketing, operations, and virtual assistance.

We connect US companies with finance and accounting experts in Latin America who become integral parts of your team.

Unlike traditional outsourcing, you get direct control and oversight while benefiting from significant cost savings and close time zone collaboration.

Here's what sets us apart:

- Fast hiring process: Candidate lists within 3 days, placements completed in under 3 weeks

- No upfront costs: Pay only after you make a hire, with flexible fee options—one-time placement fee or monthly staffing fee if you want us handling payroll and compliance

Pre-vetted talent pool: 45,000+ candidates, but we don't just search there. We find talent that meets your exact requirements and expectations

2. PwC

PwC (PricewaterhouseCoopers) is a globally recognized firm that offers a comprehensive range of finance and accounting services, including audit and assurance, tax consulting, and financial advisory.

Renowned for its industry expertise and advanced tech solutions, PwC is a great fit for enterprise-level companies with extremely complex accounting needs.

3. Deloitte

Another member of the Big Four accounting firms (along with PwC, EY, and KPMG), Deloitte offers risk management, tax, and financial consulting. With cutting-edge technology, deep industry knowledge, and near-endless resources, Deloitte provides strategic insights and scalable financial solutions.

Its global presence allows it to support businesses expanding into new markets and navigating complex regulatory environments.

4. BDO

BDO is a prominent global network of public accounting firms. It offers a broad range of finance and accounting outsourcing solutions, including:

- Bookkeeping

- Financial planning

- Risk management

- Advisory services

BDO’s personalized approach and industry-specific expertise make it a reliable partner for businesses seeking custom financial solutions.

5. RSM

RSM is a leading audit, tax, and consulting service provider for middle-market leaders. Its finance and accounting outsourcing services span from day-to-day bookkeeping to long-term financial planning and analysis.

The company’s 820 offices span the globe, and its workforce of over 64,000 people includes experts in almost every field. RSM’s focused client service model ensures that each customer receives solutions precisely aligned with their business strategy, facilitating growth and operational efficiency.

Final Thoughts

Here's what we've learned from helping hundreds of companies with their finance operations: the best approach depends on what you actually need, not what everyone else is doing.

If you want someone else to handle your books while you focus on running your business, traditional outsourcing makes sense. But if you're primarily looking at outsourcing because US hiring costs are getting out of hand, there's a better path.

Smart companies are building their own finance teams with Latin American professionals. They're getting dedicated accountants, financial analysts, and controllers who work exclusively for them—often for less than what they'd pay an outsourcing provider for basic services.

The numbers tell the story: companies save up to 70% on finance roles when hiring from Latin America, retain talent 66% longer than US hires, and get real-time collaboration from professionals who actually understand their business.

You could keep struggling with expensive US hiring or settling for outsourced services that treat you like one of many clients. Or you could do what companies like CyberFortress did—build a world-class finance team that costs less, performs better, and sticks around.

Ready to see what's possible for your finance operations? Schedule a consultation with Near and we'll show you exactly how companies in your situation have built finance teams that actually move the needle—while staying within budget.

.avif)

.avif)

%20(1).avif)

%20(1).png)