Key takeaways:

- US companies hiring in Latin America access experienced professionals they can’t afford or find domestically, with 84% of placements at mid-level or senior positions.

- Companies hiring in Latin America build full teams when needed rather than hiring incrementally, scaling departments that would take years with US-only budgets.

- US companies hiring in Latin America should prioritize finding the right talent for each role over targeting specific countries, as top professionals exist throughout the region.

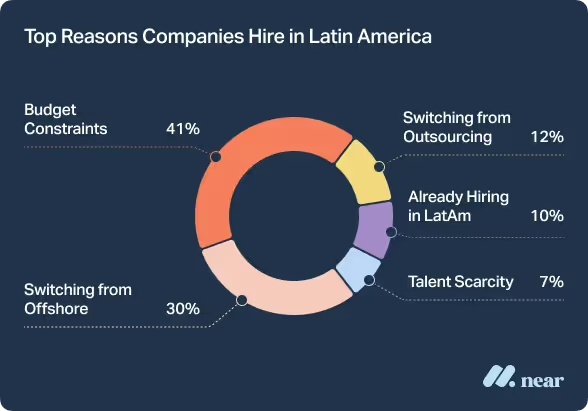

Budget constraints, talent shortages, and long recruitment cycles are pushing companies to look beyond domestic borders to hire the talent they need to grow. And Latin America is increasingly a top destination.

Near’s 2026 State of LatAm Hiring Report analyzes over 2,000 placements made by US companies over the past year across 411 roles. The data reveals some interesting trends.

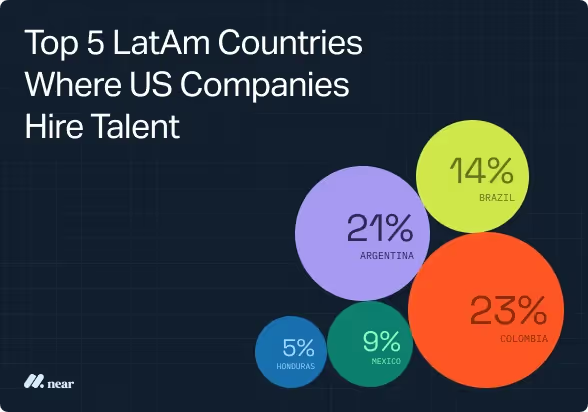

1. Colombia overtook Argentina as the top hiring destination

For the first time in our data, Colombia became the #1 hiring destination for US companies, rising from #3 to 23% of placements. Argentina, which dominated in previous years, now sits at #2, while Brazil rounds out the top three.

Colombia’s rise in popularity as a nearshoring destination is driven by strength in accounting, finance, and sales roles. Argentina remains the go-to for finance and accounting positions, while Brazil dominates marketing and IT & engineering hires.

This shift reveals something important about how US companies are thinking about LatAm hiring. While Argentina is a well-known outsourcing and hiring destination, great talent exists throughout Latin America. Colombia has tremendous strengths—from its growing tech ecosystem to its strong business culture—and companies are discovering what’s been there all along.

In our experience, the geographic spread we’re seeing isn’t about different countries being "better" at certain roles. It’s about companies realizing that top talent isn’t concentrated in just one or two countries. You can find exceptional accountants, engineers, marketers, and sales professionals across the region.

We expect this geographic diversification to accelerate throughout 2026.

What this means for hiring managers: Don’t limit your search to the most well-known LatAm countries. Great talent exists throughout the region, often with varying cost structures that can work in your favor. The country matters less than finding the right person for your team.

2. Companies are hiring senior-level professionals outside the US

One of the biggest misconceptions about nearshore hiring is that it’s about finding “cheap” junior talent.

Our data tells a different story. In 2025, 84% of placements were for mid-level or senior positions. One-third of all hires were senior-level professionals, including VPs, directors, and other executive roles.

In our experience, US companies aren’t hiring in LatAm to save money on entry-level positions they could fill domestically. They’re accessing experienced professionals they couldn’t afford—or couldn’t find—in the US market.

Specific role breakdowns reveal:

- 98% of software engineer placements went to experienced professionals

- Executive assistant roles averaged 5+ years of experience

- Senior accountants and financial controllers made up a significant portion of finance hires

As many companies will be trying to “do more with less” in 2026 and demand for experienced talent is likely to remain high, we expect this trend toward senior-level nearshore hiring to accelerate.

What this means for hiring managers: If you’ve been putting off hiring because you can’t justify US salary expectations for the level of experience you need, LatAm gives you another option. For many companies, it’s often the smartest way to scale a business.

3. Software engineering demand exploded with 250% year-over-year growth

Perhaps the most dramatic shift in the data: Software engineer placements saw 250% growth year-over-year, jumping 12 spots in the role rankings.

Large companies have been hiring developers in Latin America for years. What’s changed is that companies of all sizes—from startups to mid-market—are now making this move.

And we’re seeing something else: a significant shift from teams working with developers in South and Southeast Asia. They are moving to Latin America because of the time zone advantages.

In our recent report on why US companies hire in Latin America, we found that 30% of companies were switching from hiring in further offshore locations. The reason? When urgent development decisions need to be made or problems need solving, overnight delays slow everything down.

Here’s where AI comes into play. While the initial hype suggested AI would reduce demand for engineers, our experience tells us it’s had the opposite effect. We’ve seen that it has increased demand for senior engineers.

What AI changed is which engineers you need. Teams still require judgment: senior engineers who decide how to build, what to prioritize, and whether AI-assisted code is ready to release. (We dive deeper into this in our article on why US companies are choosing LatAm for tech talent.)

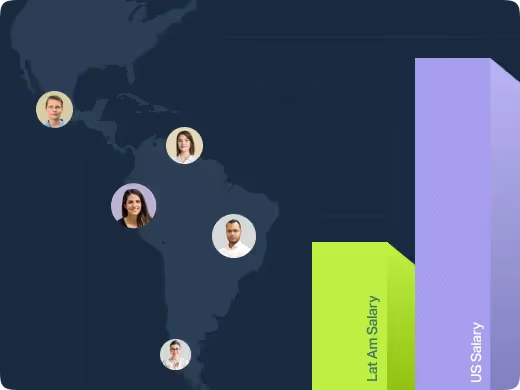

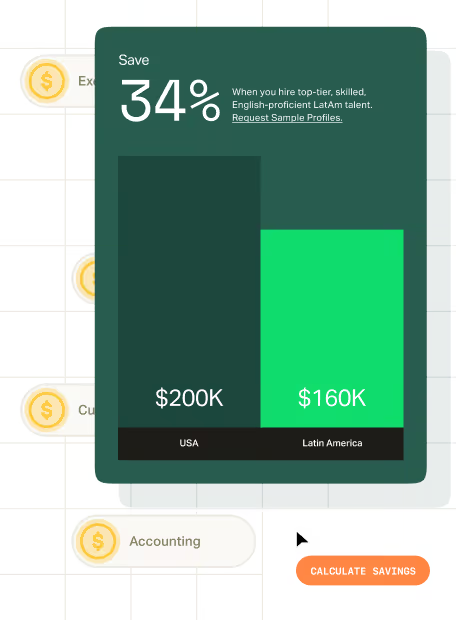

In the US, that senior-level talent is in high demand and expensive. In Latin America, you can find senior developers who work during US business hours at rates that are 36-56% lower than US salaries—but still high enough to attract top-tier talent.

As AI continues to reshape how development teams work and the need for senior oversight only increases, we expect engineering to be one of the fastest-growing categories again in 2026.

What this means for hiring managers: If you’ve been struggling to fill engineering roles or justify the budget for hiring an experienced developer, LatAm offers a way to get both the seniority you need and the time zone alignment that keeps work moving. As more companies discover this combination, getting ahead of the curve now means you’ll have access to talent before competition intensifies further.

4. BDR/SDR remains the most-filled role (and for good reason)

Business development representatives (BDRs) and sales development representatives (SDRs) continue to dominate LatAm hiring for the second year running, maintaining their position as the most-filled role type.

From our perspective, working with hundreds of growing companies, the reasons are clear:

- Average savings of 58–64% compared to US salaries

- Average placement time of 28 days (compared to 3-6 months domestically)

- Relatively easy to find candidates with strong English proficiency

- Time zone alignment enabling real-time collaboration with US customers

Among top sales reps in LatAm, English proficiency is exceptional. In our experience, clients often tell us prospects don’t realize they’re speaking with someone outside the US. We regularly place sales professionals with neutral accents and a level of English fluency that means sales teams can represent brands without communication barriers.

In our experience, companies aren’t just filling one or two sales positions. They’re building entire sales teams in LatAm, often hiring 5–10 SDRs or BDRs at a time. This isn’t about replacing US salespeople. It’s about building the pipeline generation capacity that would otherwise be financially out of reach.

For example, AvantStay’s VP of Sales built an 18-person SDR team entirely with LatAm talent. Their first hire was promoted to team lead within three months. That team added $20M in ARR through outbound sales in just one year. AvantStay is now saving over $1M in annual payroll costs.

As companies continue to look for ways to scale revenue without proportionally scaling costs, we expect sales roles to remain the dominant category in 2026.

Close behind BDRs/SDRs are accountants, customer support representatives, and executive assistants—roles that benefit from the same advantages of cost savings, time zone overlap, and fast placement times. But we also continue to see that LatAm hiring works for any role that can be done remotely.

What this means for hiring managers: If you’re considering LatAm hiring, sales is one of the lowest-risk starting points. The track record is proven, the talent pool is deep, and the ROI is immediate. We see many companies start here before expanding into other departments. It’s a smart way to build confidence in the model.

5. The savings from hiring in Latin America enable growth

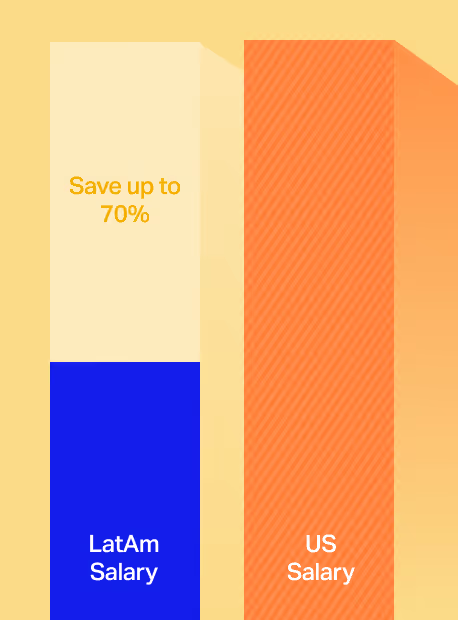

The data shows companies save an average of $35,000 to $64,000 annually per Latin American hire compared to US-equivalent positions.

Many companies aren’t using these savings to pad profit margins. They're using them to build larger teams sooner. For example, they’re hiring 5 people instead of 2, or launching entire departments they would have had to delay for years with US-only budgets. The savings enable immediate scaling rather than incremental, budget-constrained growth.

In our experience working with over 700 companies, the pattern is remarkably consistent. Companies that hire nearshore talent:

- Build entire departments after their first few hires

- Fill roles in 7-28 days that previously took 3-6 months

- Access senior-level expertise they couldn’t afford or find domestically

- Scale operations 40-100%+ in a single year

- Redirect savings into growth initiatives, technology, and strategic hires

As economic pressure continues in 2026, we expect more companies to use nearshore hiring as a growth lever rather than just a cost-saving tactic.

What this means for hiring managers: The real value isn’t just lower salaries. It’s being able to hire the team you actually need and not the scaled-down version your budget forces you to settle for with purely domestic hiring.

What this means for your company

Based on what we saw in 2025, LatAm hiring has moved from "alternative option" to "standard playbook" for many growing US companies. Our research shows companies are using nearshore talent to:

- Fill roles they’ve been unable to fill domestically

- Hire senior-level professionals previously out of budget

- Scale departments before they have the budget to hire in the US only

- Reduce time-to-hire from months to weeks

The companies winning with LatAm hiring aren’t chasing cost savings first. They’re pursuing access to top talent. The cost savings are real, but they’re a byproduct of a smarter hiring strategy to build high-performing teams.

If you’re facing budget constraints, struggling with long hiring cycles, or can’t justify US salaries for the roles you need to fill, the data shows a clear path forward.

Want to see what’s possible for your team?

Book a free consultation call to discuss your specific hiring needs.

In just 20 minutes, we’ll give you salary benchmarks for the roles you’re looking to fill, explain our process, and answer any questions you have. No commitment. No sales pitch. Just a way to explore if hiring in LatAm could work for you.

To dive deeper into the data, download the full State of LatAm Hiring Report.

{{latam-hiring}}

.avif)

.avif)

%20(1).avif)

%20(1).png)